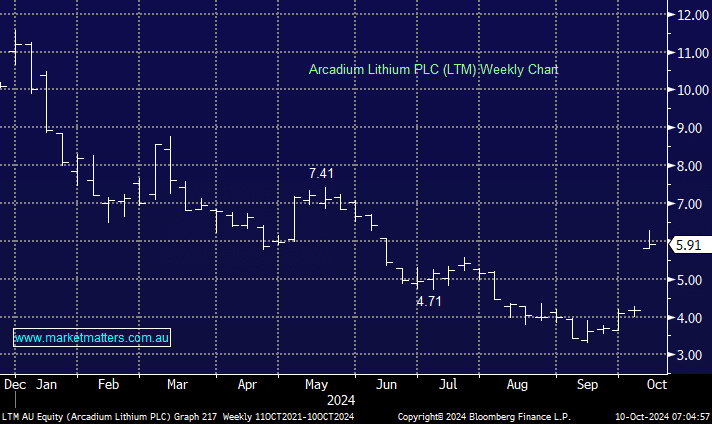

RIO’s purchase of Arcadium Lithium (LTM) for $5.85/$9.9bn is almost old news as the heavyweight miner follows through on its plan to become a significant lithium (Li) player. The move should offer some condolences to LTM shareholders who’ve seen the stock plunge ~70% in 2024, illustrating the volatility and recent weakness in the sector. Li has been on a rollercoaster ride over the last five years, with the recent 85% decline being driven by old-fashioned supply/demand imbalances, i.e. global production was been ramped up while demand for EVs has disappointed, especially in the US. However, as we’ve said before, the best cure for weak prices is weak prices themselves!

We like the contrarian timing of RIO’s purchase, with the heavyweight miner saying it is not worried about price movements over the next year. However, they anticipate decades of increasing lithium demand amid the global economy’s electrification. However, it’s important to note that while they may have bought one of the world’s largest lithium producers, it’s still relatively “small change” for the Goliath diversified miner and won’t change existing capital expenditure plans or its dividend policy. Another critical aspect of the move by RIO is the replacement value; if they were to try and create a similar beast, it could cost significantly more money.

- We believe Li stocks continue to look for a low, but the commodity might not turn for 12-24 months.

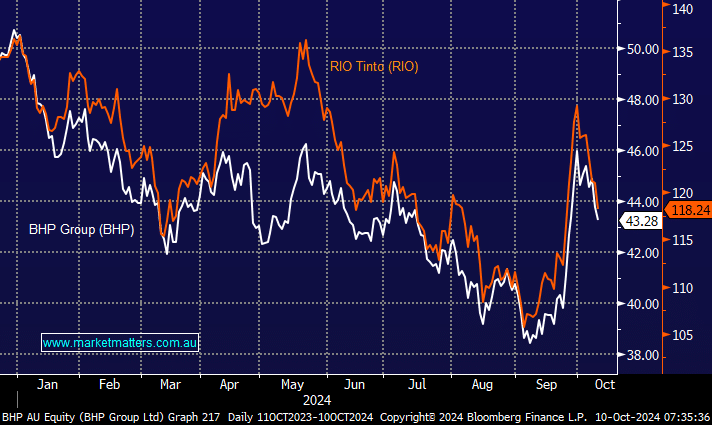

We don’t see this acquisition as a compelling reason to reconsider RIO for diversified resources exposure. We still prefer and own BHP Group (BHP) and South32 (S32).

- We prefer BHP’s goal to expand its Copper presence over RIO’s foray into lithium. However, it’s proving harder after its recent failed bid for Anglo American (AAL LN) – a bid over 5x larger than RIO’s purchase of LTM.

This morning, we revisited 3 Li stocks that may have some legs following RIO’s initial foray into the space.