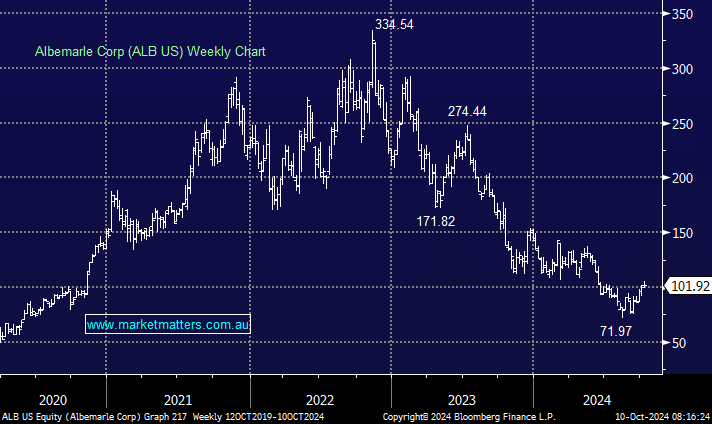

We caught this falling knife in February with our position down 11% since. While it could have been timed better, we like the company’s medium-term outlook. A crash in Li prices has pushed US miner Albemarle (ALB US) to halve production and stop expansion at its $2 billion lithium hydroxide plant in southwest Western Australia. It has also shed 300 workers and written down the asset’s value by about $1.5 billion. These sorts of dramatic actions often unfold towards the end of a bearish cycle, and while MM isn’t saying it’s time to go “all in”, we believe the sector is “looking for a low”.

- We like ALB medium term but aren’t considering averaging our 4% position above $US100 – MM is long ALB US in our International Companies Portfolio.