Are any high-flyers now showing some value? (A2M, ALL, FLT, WEB)

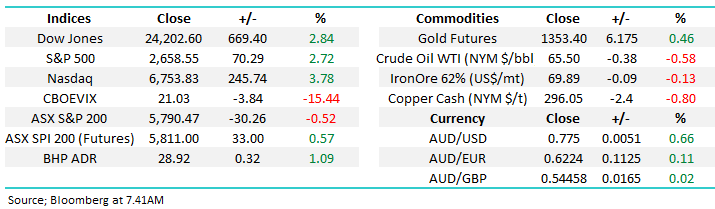

The ASX200 had a reasonably good Monday only falling 30-points / -0.5%, following the Dow’s 424-point / -1.8% plunge on Friday night. The Energy, Healthcare and Gold sectors managed to close in the green, while the overall market was supported by strong US futures which were pointing to a strong bounce on global markets, assuming of course we get no more shenanigans from President Trump. This morning we wake up to another moment of déjà vu, as the local market has “picked” the overnight performance of US indices to a tee.

The initial rally by US futures during our time zone was no surprise on our end as historically, strong sell-offs on the 4th Friday of the month are usually followed by strong bounces – perhaps US fund managers don’t want to look too bad at the end of the month? However last night, markets certainly embraced the 2 small pieces of optimistic news around a trade war we mentioned in yesterday morning’s report, sending the Dow soaring +669-points for its largest one day gain since 2015. The financial sector was a standout winner, rallying +3.3% which should bode well for our influential finance sector today, with the overnight futures market calling the ASX200 to rally ~30-points on the opening this morning.

We can easily envisage a bounce by the ASX200 to the 5850 area, but a close above 5900 is still required for us to become bullish short-term.

Today’s report is going to take a closer look at moves on overseas markets plus check out 3 popular recent high-flyers to asses if any potential value has emerged.

ASX200 Chart

Overseas Markets

Overnight the US broad based S&P500 soared +2.72% to continue the choppy trading action since February between 2872 and 2532. From our technical perspective, the more time the S&P500 spends between 2600 and 2800 the greater the potential for a renewed rally to fresh all-time highs.

Overall we must remain neutral just here, but our preferred scenario moving forward still remains a doomed attempt to break upwards towards the psychological 3000 area.

US S&P500 Chart

The Emerging Markets, which are very highly correlated to our resources sector, remain firmly on track to make fresh highs in 2018.

MM plans to take profit on our large resources exposure if / when this advance unfolds.

Emerging Markets (EEM) Chart

Lastly moving onto our current pet favourite, the $US which we have watched carefully since the start of 2018.

Our view remains intact that the $US would fall to important lows, probably under the 88 region, before we will get particularly concerned with equities and especially the resources sector i.e. roughly another -1.5%.

Expect MM to be selling stocks / buying $US exposure into a move below 88 for this index.

$US Index Chart

Now to look at 3 stocks who have grabbed the headlines over the last few years for all the right reasons.

Subscribers should remember that we are in “sell mode” and hence will be extremely fussy with any buying moving forward.

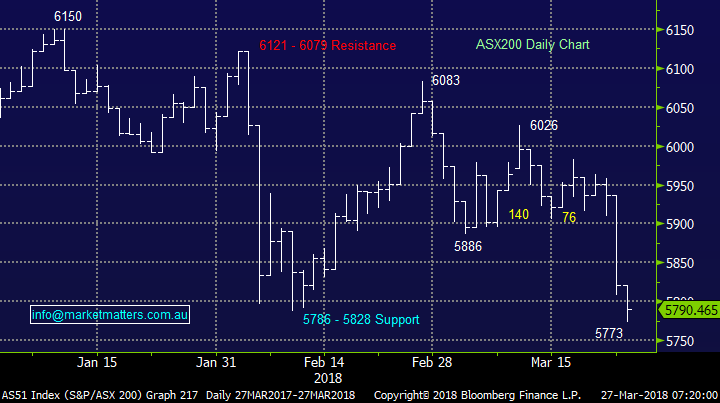

1 A2 Milk (A2M) $12.44

A2 Milk (A2M) has enjoyed an amazing rally this year, some of which we enjoyed at MM, but unfortunately we missed the last significant profit upgrade.

We are now wary of the high 46x valuation and the market appears to be on the same page as the stock has been treading water for ~5-weeks, although it has clearly ignored much of the recent US driven market volatility.

MM is a buyer of A2M around the $11.50 region, or 7-8% lower.

A2 Milk Co (A2M) Chart

2 Aristocrat Leisure (ALL) $24.46

ALL made fresh highs last week, but the rally since mid-June has been on significantly reduced momentum compared to previous years. While we still like the company fundamentally and the valuation at 23x is not overly demanding, we are very wary of the technical picture. Technicals can often give a warning that fundamentals are slow to identify.

MM likes ALL, but at this stage we have no interest until ~$20 i.e. over 15% lower.

NB In this case it may not be a problem with ALL, but the looming decent correction for equity markets as a whole.

Aristocrat Leisure (ALL) Chart

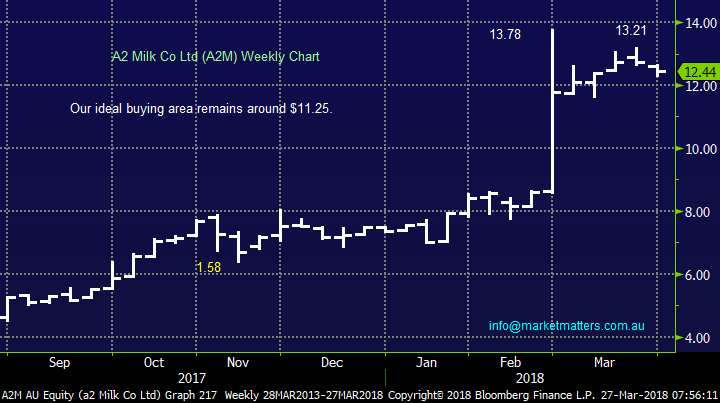

3 Flight Centre (FLT) $56.85

FLT has risen from the ashes over the last year, basically doubling in price. The current valuation of 21x is not scary and a 2.7% fully franked yield is a nice bonus after such a strong rally.

However we see limited risk / reward for buyers at current levels and feel more comfortable with our holding in on-line competitor Webjet (WEB).

Flight Centre (FLT) Chart

Webjet Ltd (WEB) Chart

Conclusion

- We remain overall cautious stocks at present due to our medium-term bearish view but in the short-term we are 50-50 and have definitely not ruled out our previous call of one more high for equities in 2018.

- We see no close opportunities in the 3 stocks we looked at today.

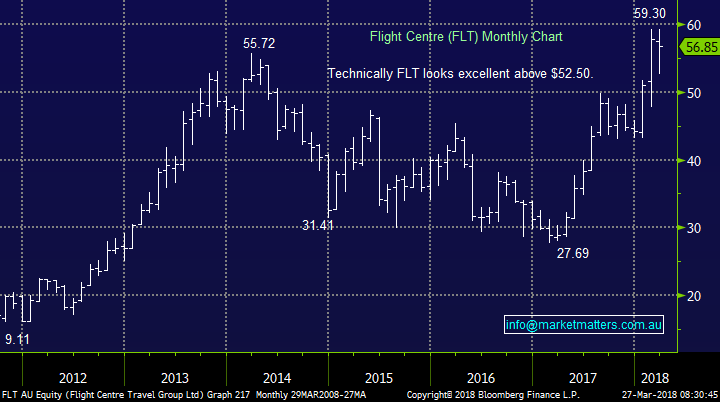

Overnight Market Matters Wrap

· ‘Trade war’ tensions eased overnight, sending the US indices to bounce over 2.7%, led by the tech and financial sectors.

· The Volatility (VIX) Index dropped 15.44% as tensions eased, however Dr. Copper, a leading indicator of global economic health continues to slide, with copper off 0.8% overnight.

· With the financials exposed to the US likely to outperform the broader market (e.g. Macquarie Group – MQG), we also expect a bounce in the resource sector, with BHP in the US ending its session 1.09% higher to $28.92 from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 33 points higher, testing the 5825 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/03/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here