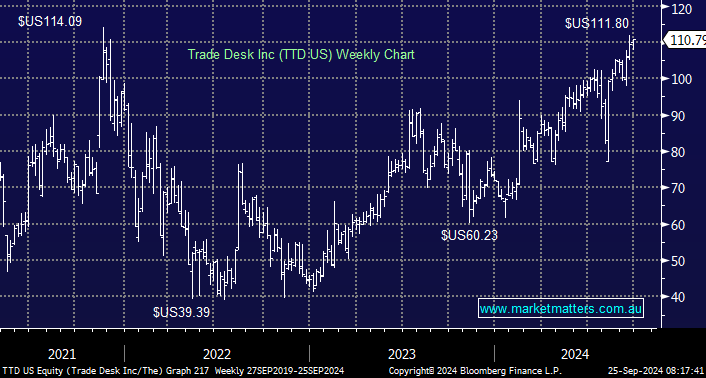

We haven’t touched on our position in The Trade Desk (TTD US) since they reported a strong 2Q result and good guidance for Q3 around six weeks ago, with the stock up ~25% in that time frame to be now testing all-time highs. While our position is up ~150% since first buying into TTD in April of 2020, it has been somewhat of a wild ride, more so with regards to the multiple the market is prepared to pay for TTD more than the underlying performance of the business.

At its most recent update, the advertising technology company highlighted that its accelerating growth was coming with better profitability—a very strong sign. Normally, growth slows when profitability becomes more of a focus, but TTD has one of those platforms that can deliver both simultaneously.

- In FY20, when we initially bought the position, TTD produced revenue of $US836m and underlying earnings (EBITDA) of $211m. In FY24 (Dec year-end in the US), consensus has them pegged at $US2.45bn in revenue, with underlying earnings (EBITDA) of a bit over $US1bn.

At ~ US$110, it’s hard to argue that TTD is not on the richer side, but it’s not excessive. If they continue delivering as they have done and the operating leverage shines through, we still think TTD can rally further. Noting that while there are 28 buys on the stock and only 9 holds or sells, the consensus price target is around current levels.

- We don’t want to lose our position in TTD as the operating metrics increase.