US equities finished lower after the Feds move overnight, but we don’t read too much into a 1-day knee-jerk reaction. Let’s go back in history and look at what happens after the Fed starts cutting interest. One binary characteristic does stand out, which is probably a function of market expectations into the cutting cycle:

- If the US equity market struggles over the coming fortnight, it’s likely to be a tough 12 months and vice versa.

Swings by AI giant Nvidia are pushing the tech-based NASDAQ around, our stance at this stage hasn’t changed; we are keen buyers around the 17,000 area while we wouldn’t be chasing strength up towards 21,000 i.e. range trading looks likely into Christmas.

- September remains on track to deliver a choppy consolidation-style month after August’s aggressive swings in both directions.

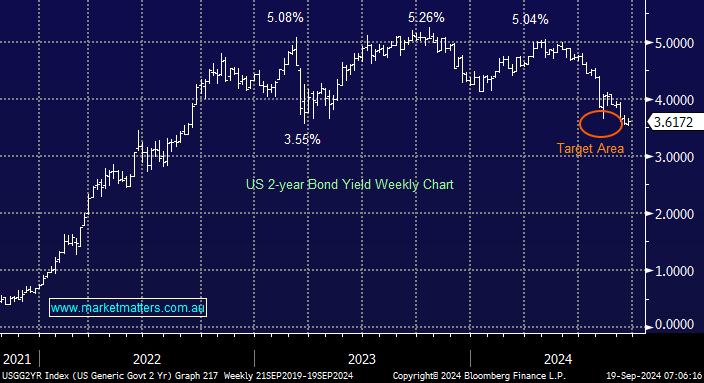

US short-dated bonds consolidated recent gains following the Fed’s move; yields have now reached our long-dated target area, and fears of a recession are needed to push the 2s significantly below 3.5%. On balance, we actually feel a bounce is likely, which may weigh on rate-sensitive names.

- We expect the Fed to cut rates by 0.25% this month and maintain a steady path over the coming months, enabling Jerome Powell et al. to determine the economic impact.

Having recently battled with Telstra/Bigpond over the deliverability issues of MM’s reports, we felt drawn to updating our view of three listed ASX telcos—after all, nobody ever bought an Australian Telco for their service!

- Fingers crossed, we found a successful “workaround” overnight, but we never did find a person at Telstra to explain why and how we fixed the issues they triggered. They are as rare as Tasmanian tigers!