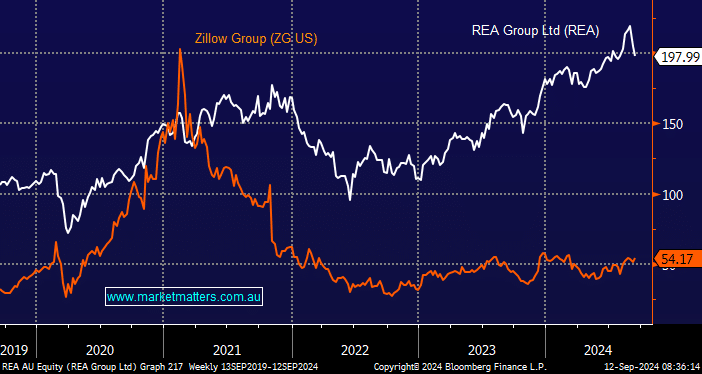

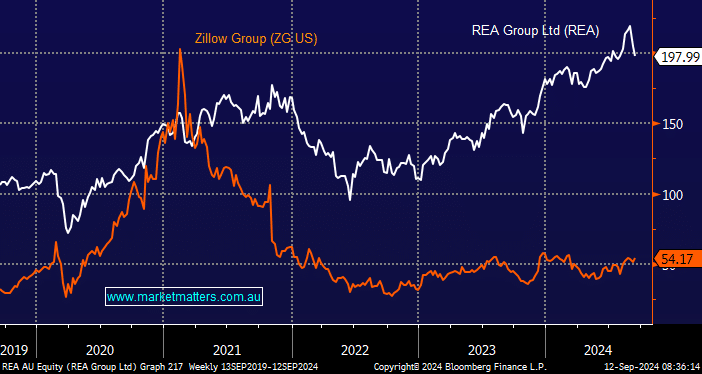

Zillow Group Inc (ZG US) is our preferred global property classified play following REA Group’s (REA) ~$11bn bid for UK Rightmove (RMV LN), which, not surprisingly, has been rejected – let the games begin. US-operated ZG has a market cap. of ~$19bn, or 75% of the size of REA. We liked ZG’s 2Q result in August, reaffirming our view that the stock is turning around nicely, with our June purchase already up ~30%, i.e. we are happy to buy stocks that have rallied as well as picking up quality names into dips.

- ZG is trading 55% below its average PE over the last 5 years, whereas REA Group (REA) is trading 2% above even after its bid for RMV.

- We were conscious that, as illustrated by REA and Domain, this is a sector where strength usually prevails, but we see the risk/reward favouring ZG at this stage.

In simple terms, if ZG can continue to gain traction in the much bigger North American market, as we’ve witnessed from REA, the stock can easily compound its recent gains. The Fed is set to cut rates next week and another 8-9 times over the coming year, which should inject further life into the US property market and provide an added macro tailwind to ZG.

- We plan to add to our ZG position for our International Equities Portfolio tonight.