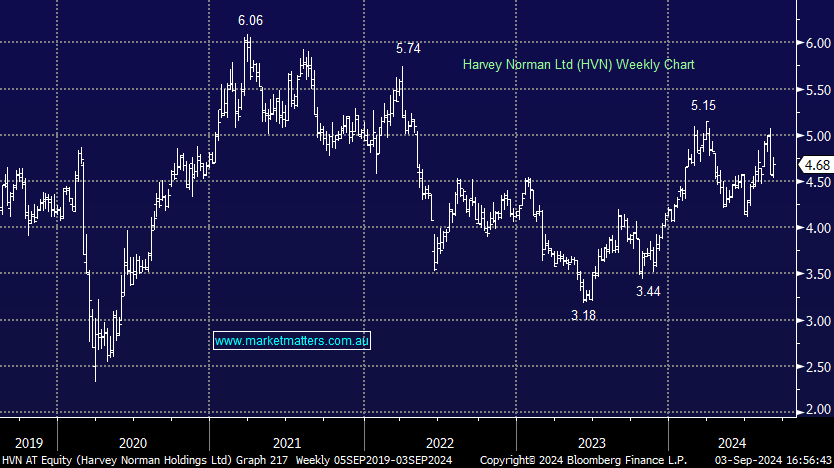

HVN +1.74%: Has been a big underperformer relative to some of the other discretionary retailers YTD, up 12% versus JB Hi-Fi (JBH) up 54%. A better share price performance from JBH is justified given their better financial performance, however, HVN now trade on a ~30% discount from a relative PE perspective vs JBH, a ~40% discount to the ASX Industrials (ex-Financials) and an EV/EBIT multiple (ex property) for FY25e of ~9x, or in other words, it screens value. We are in a market that is gravitating towards the strength, with earnings certainty & safety being highly regarded, however, that will change at some point, trees don’t grow to the sky, and being open to the laggards is important for what may come next.

- Our view last month on HVN was anchored to JBH, suggesting we still prefer JBH, however given the relative moves since, HVN is starting to look interesting again.