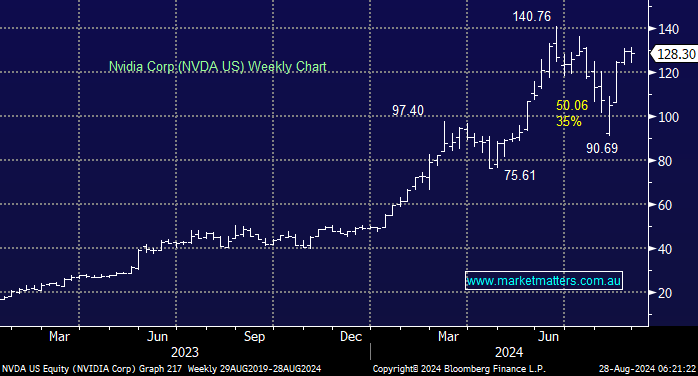

Optimism is high ahead of NVDA’s much-anticipated result, due early Thursday morning AEST. In the past four quarters, Nvidia has posted operating earnings surprises of 31.6%, 19.4%, 11.9% and 9.8%, respectively. Even more impressive is that Nvidia has posted these beats with its older AI chip, the H100 GPU. Nvidia is now transitioning to its new AI chip, the Blackwell GB200 GPU, which has been delayed; however, the magnitude of the pre-orders are phenomenal.

Alphabet, for example, has ordered more than 400,000 GB200 chips worth more than $10 billion. Meta also has a $10 billion order, while Microsoft is expecting to have 55,000 to 65,000 GB200 GPUs ready for OpenAI by the first quarter of 2025. Clearly, NVDA has no issue with demand; however, the guidance around when they can deliver on these orders is one of the key variables playing into Thursday’s result.

- When a company has such a dominant position, others will naturally try to compete; however, to date at least, no one else is coming close despite spending billions on R&D. It’s this dominance that makes NVDA so powerful.

The 74 global analysts that cover NVDA form the consensus, and the key numbers to look for in their Q2 result will be;

- Q2 Revenue of at least $US29bn up 140% YoY

- Net Income of at least $US16bn up 137% YoY

- Q3 guidance for revenue of at least $US31bn, up 76% YoY

- Q3 guidance for Net Income of at least $17.6bn up 71% YoY

Given the high optimism and the fact that they traditionally beat, the above will be the base case only. This is an important result for the stock’s performance, and because NVDA has evolved into a US tech behemoth, it is 7% of the S&P 500 and over 8% of the Nasdaq.