Sell strength, but should we buy weakness? (CGF, CBA, AMP, MQG)

Overnight US markets cooled with all three major indices finishing in the red, the NASADAQ seeing most weakness after a reasonable 14 day rally that saw the tech dominated index up by ~7% - a similar advance from the broader S&P 500 which has also rallied ~6.4% from the early April lows. The markets have gotten some ‘swagger’ back over the last couple of weeks with stocks up and volatility sliding -25.73% to 15.96, highlighting a new degree of complacency creeping into to market. Remember, we still see the large drop in February as a shot across the bow, a warning signal for a deeper correction latter in 2018/19 – this is a market where complacency will be punished as some point.

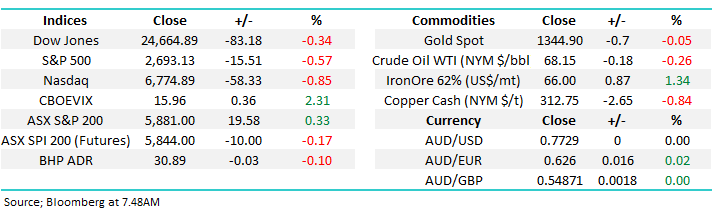

This morning the ASX200 is expected to open down ~18 points giving back yesterday’s gains. There has been a significant divergence between sectors on the ASX over recent months but that divergence has ticked up a notch in the last week or so with anything financially related on the nose while the resource stocks have enjoyed a strong tailwind of higher commodity prices, in part courtesy of Donald’s Trumps proposed sanctions towards Russia which has an impact on some materials such as Alumina and Aluminium + Nickel has also seen a 8.08% rally in its price, however the bulk commodities have also been very strong, Iron Ore up 5.2% from recent lows while Copper has now broken higher.

At Market Matters, we remain mildly bullish the local market however yesterday we saw the ASX 200 once again fail to hold above 5900 by the close, clearly a negative sign. From a timing perspective we’re now approaching the seasonally weak period of May, therefore our conviction starts to wain on whether or not stocks will re-test recent highs in the short term.

ASX 200 Chart

Sell strength, but should we buy weakness?

We’ve often written about this being a market that will reward active management and part of active management can often be selling into areas of strength – when positivity is high, to buy into areas of weakness, usually when negativity is high. Clearly many financially related stocks have been under significant pressure while the resources / growth related stocks have been doing well. Yesterday we used the strength in Rio Tinto to take a nice 12% profit in a little over 2 months while last week we sold Alumina for a 25% profit in about the same time frame.

In terms of Alumina, we left upside on the table however we’re comfortable setting a plan and following it. We now hold the following resources stocks across both portfolios; BHP, Oz Minerals, Orocobre & Fortescue Metals – with the intention of selling into strength.

Most weakness is clearly playing out in the financial space and it seems that many (MM included) underestimated the impact of the Royal Commission on share prices. The shocking admissions coming from AMP and prior to that, the banks own financial planning operations will have lasting effects. CBA’s CEO Ian Narev has fallen on his sword, this morning AMP’s Craig Mellor has just resigned effective immediately (he was retiring at the end of 2018) and significant change is clearly in the air.

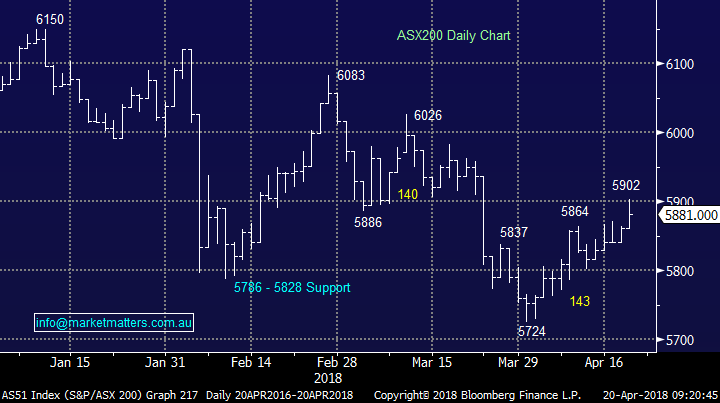

In the US, Financial stocks remain bullish which in time should provide a positive backdrop for our local sector.

S&P 500 Financial Index

Today lets looks at 4 financial stocks that have been hit hard in recent weeks;

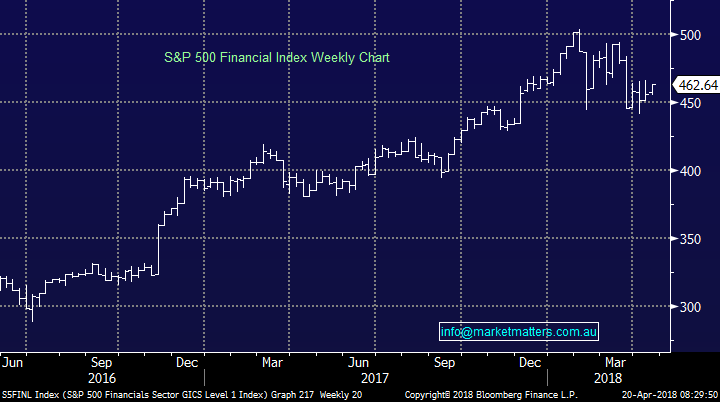

AMP; Is in the vortex of the storm and simply it seems it will get worse before it gets better for AMP. AMP is a vertically integrated operation meaning that they provide advice, but also manufacture / develop products for clients to invest in. They then make it more attractive in a variety of ways for Planners to recommend the AMP products over and above others. This is a model that will now come under significant pressure with the Royal Commission just being the start. ASIC is set to investigate further and a class action, or multiple class action’s from consumers and shareholders seem likely.

AMP has fallen from $5.47 to $4.32 yesterday, a drop of 21% since the start of March. We have no interest in AMP

AMP Chart

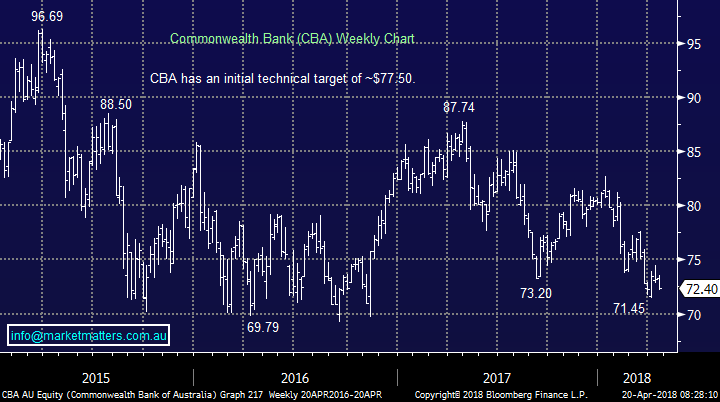

Commonwealth Bank (CBA); The major banks are subject to the royal commission just like AMP, however, their wealth management and insurance businesses are much smaller than AMP’s relative to the size of their banking businesses. CBA’s entire wealth management business for instance accounts for just ~5% of earnings. CBA is good at banking but has been poor in the wealth management space (generally speaking), and it seems that the banks will simply sell off (if they already haven’t done so) the areas that are causing issues.

For that reason, the banks will be less impacted by the outcomes of the Royal Commission in terms of their core earnings. The main issue facing the banks is credit growth and the related revenue and profit growth. We think banks can achieve 5% credit growth and 3% revenue growth and on forward PE of 12x, the sector is cheap. Dividends should be maintained, if not increased, and they are typically trading on yields of 6%.

We remain keen on the banks at current levels

CBA Chart

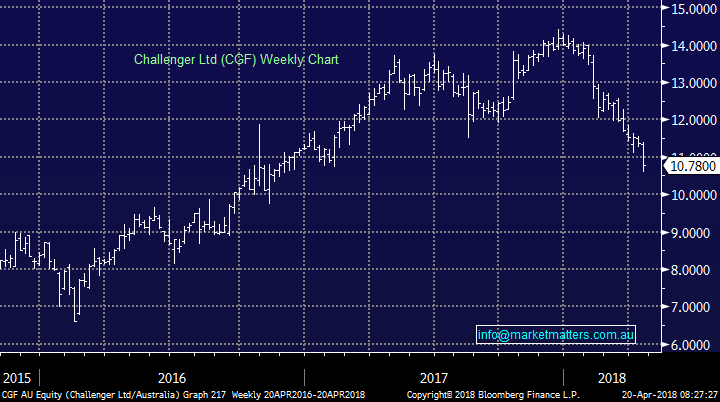

Challenger Group Financial (CGF); This has been a favourite play over the years for MM and we’ve successfully traded the stock a number of times. Our most recent sell was at the end of November 2017 at $13.80. This stock closed yesterday at $10.78 and from a price perspective it has twigged our attention as being cheap, however the worm (in terms of earnings) has clearly tuned for the large Australian Annuities provider. CGF is a momentum business, when annuity sales are strong and markets are reasonably calm, the business does well. When sales slow, as they have, and markets become more volatile as they have, Challenger’s earnings will struggle.

Given our broader outlook for increased volatility, we have no interest in Challenger at current levels.

Challenger Group Financial (CGF) Chart

Macquarie Group (MQG); We often speak about leverage in funds management businesses and this is clearly the case with Macquarie, while it’s also highly leveraged to the equities market. For instance, if Macquarie grows revenue by 2% that gives them profit growth of 5%, however this trend cuts both ways. While we like (and own) Macquarie at current levels, this is a play on equity markets that we expect will peak later in the year, before a more damaging 20% correction. Just like Challenger, Macquarie is not a business to own in times of weak markets.

We are targeting $110 as a sell for Macquarie but may offload sooner

Macquarie Group (MQG) Chart

Conclusion (s)

- We will continue to sell strength in resource stocks

- We have no interest in AMP or CGF at current levels

- We remain keen on the banks, and will sell Macquarie into strength

Global markets

US Indices

While we expect US stocks to rally to fresh highs the likely manner of the advance is far more choppy / indecisive than the almost exponential gains we have witnessed from late 2016 – feels accurate at the moment.

US Dow Jones Chart

European Stocks

European indices have picked up over recent weeks potentially we’ve seen their low for a few months.

German DAX Chart

Asian Stocks / Emerging Markets

We remain bullish the Hang Seng at current levels ideally targeting fresh 2018 highs– also this adds weight to our preferred scenario that the $US can see one final low in the coming weeks.

Hang Seng Chart

Overnight Market Matters Wrap

· The US major indices closed lower overnight, led by the tech heavy NASDAQ100 as investors weigh the risk on smartphone demand.

· The financials were the outperformer from the broader market on the back of rising bond yields and positive earnings data.

· Base metals closed lower as analysts speculated that Russia may temporarily nationalise Rusal, easing supply concerns. AWC rallied circa 30% since the end of February, and with some commentators calling the rally in base metals overdone, it will be interesting to see how it performs from here.

· The June SPI Futures is indicating the ASX 200 to open 17 points lower towards the 5860 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here