Reported Q2 results after market in the US overnight, and while the stocks was up 2.3% ahead of the results, they traded down after hours by ~5%.

- Revenue of $US868.8 million, +29% y/y, and ahead of consensus of $US850.7 million

- Adjusted diluted EPS 18c vs. 22c y/y, estimate 16c

- Though, they have lost money in the period due to front-loaded spend on new initiates.

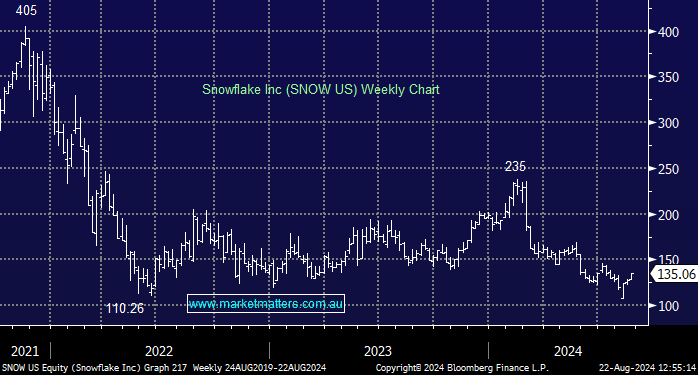

Our last update on the stock (here) had us turn more neutral. While we believe Snow remains a very strong business, still growing the top line at over 30% driven by increasing demand for data underpinning AI, the challenge for the stock is that the pay-off period on new product launches could be a year or two away, and there are a lot of variables at play, making it a more complicated growth story in the near term.

The results overnight did not change that view, and with some pending changes to the International Equities Portfolio close at hand, our position in Snowflake is in the mix.