Newmont (NEM) is the world’s largest producer of Gold having bought Newcrest in 2022, however Barrick sits comfortably in No 2 spot, and on Monday they guided to FY24 gold output of 3.9-4.3m ounces at an all-in-sustaining cost base of $US1320 to $US1420. With Gold prices at US$2464 this morning, the metrics of their diverse operations really stack up.

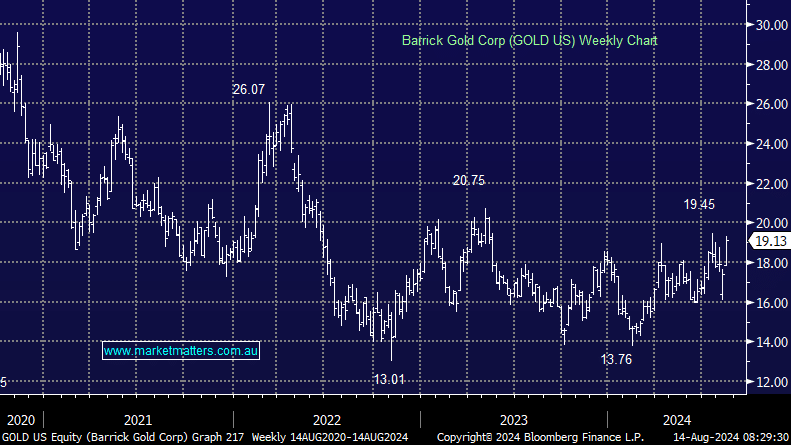

This week’s 2Q results came in ahead of expectations, and the share price has rallied ~10% since. We’ve held Barrick in the International Equities Portfolio since 2021, and it’s tested our resolve on several occasions, and we could have traded this position a lot better. Operational issues, like many gold companies, have seen their shares underperform the strength in the underlying commodity. It’s a lot easier to comment on operational issues than actually run a gold company, we understand they are very complex, however, pleasingly, this weeks update showed a strong operational improvement, which drove a better financial outcome for investors.

While the $3.16bn of revenue was inline with expectations for the quarter, better execution drove an 18% beat in earnings (EPS), which underpinned the positive move in the share price. They reconfirmed key guidance for the FY, and if the gold price continues to rally, we expect Barrick to now better reflect that in its share price.