Last week, we saw REA deliver a solid result, which included revenue of $1.45bn and Core Net Profit After Tax (NPAT) of $461 million, up +24% yoy, both of which were slight beats. The property market is on a solid footing for REA with homes selling noticeably faster than the average over the last six years while listings remain strong and rate cuts are likely to stoke the fire even further. REA is expensive, particularly when we compare it to our other play on the same space in the US via Zillow (ZG US).

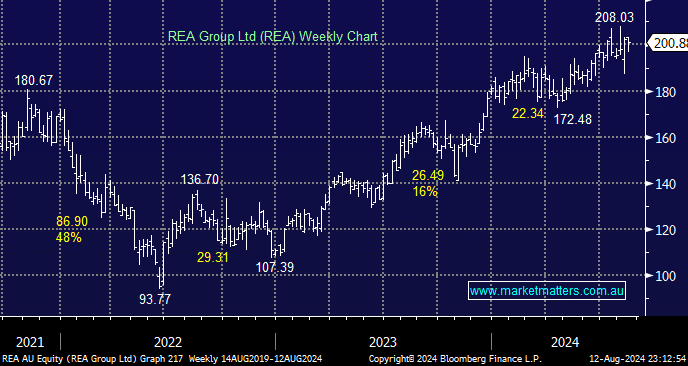

Clearly, REA is a top-quality business, but it’s hard to get excited around $200, especially as it has experienced a 10% pullback almost every year.

- We can see REA posting fresh highs in the coming months but the risk/reward isn’t exciting above $200.

- We can see REA rotating around the $200 area into Christmas, but we do have a bullish bias as the market embraces quality.