Hi Manie,

In hindsight we haven’t played BHP as well as we could have in our Active Growth Portfolio although we discussed what comes next for the “Big Australian” next in Thursday’s What Matters Today Report In other words were disappointed not to have added more value (alpha) having called BHP pretty well over the last few years:

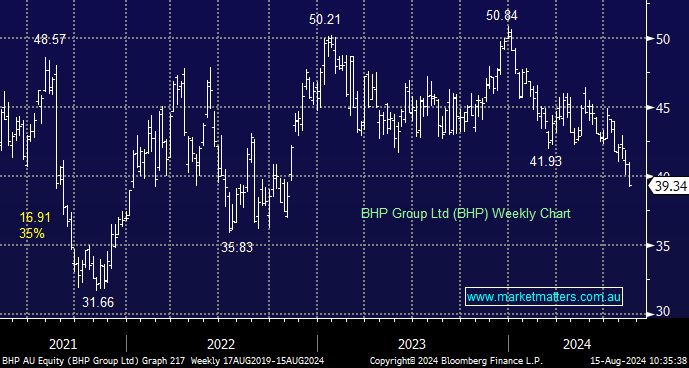

- For most of the last 12-months we called BHP to trade between $40 and $50 hence although we have an underweight position in BHP we should trimmed further ~$50.

- Now BHP is below $40 we are looking to increase our 8% position up to 10%.

NB BHP Group (BHP) currently represents ~9.8% of the ASX200.

BHP is indeed a cyclical stock as you say which can add excellent value to growth portfolios when well-timed and of course vice versa. Fortunately we bought well and in this case the dividends have delivered a decent return so far, but your point is a very valid one. In terms of growth from here, it is all about growth in earnings by increasing production to meet the worlds demand for commodities, particularly those that will be instrumental in the Energy transition and AI.