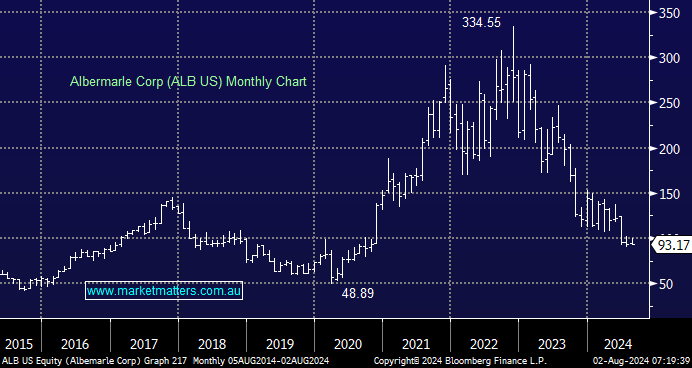

BHP recently announced that their Nickel West operations and West Musgrave project will be temporarily suspended (mothballed) from October 2024, with an estimated 7000 jobs lost in WA following the nickel price collapse due to excess supply out of Indonesia. Fortescue (FMG) is cutting ~700 jobs as it pulls back on its hydrogen dream, and now Albemarle, the world’s largest lithium producer, has announced 300 job losses as they reduce operations in WA. The Lithium (Li) price has collapsed almost 90% from its panic-like 2022 high, which should remind all investors that the resources sector is a cyclical space, i.e. when prices rise, miners strive to profit by increasing output/supply.

Supply is estimated to exceed demand for Li over the coming years, although analysts have struggled to estimate the speed at which people will adopt EVs accurately. We’re conscious that mines are often mothballed towards the end of a bearish cycle, posing the question of when investors should increase exposure. As the common saying goes, the remedy for low prices, is low prices themselves.

Interestingly, this week, the RIO Chief said he wanted to increase their lithium business, and Australian Super increased its position in Li producer Pilbara Minerals (PLS) to 9.4% as they fade today’s current bearish backdrop. Plus, Kamala Harris is looking like a good bet to beat Trump, which will deliver a better macro backdrop for the whole ESG space.

We caught the Albemarle (ALB US) falling knife in February, a touch early but nothing too painful yet.

- We like the risk/reward of ALBs under $US100, but importantly, it may take time – MM owns Albemarle Corp (ALB US) in our International Companies Portfolio.