US equities surged higher overnight following Jerome Powell’s dovish comments. If earnings reports this week can provide some support, the recent market wobbles could quickly be over. However, even after last night’s gains, the NASDAQ still finished July down -0.8%. Nvidia’s best session since February was inspired by better-than-expected results from rival Advanced Micro Devices (AMD US), which re-ignited optimism in the semiconductor space.

- We adopted a neutral/cautious stance toward the Tech Sector after it hit our targets in late June, but last night’s move brought new highs back into play.

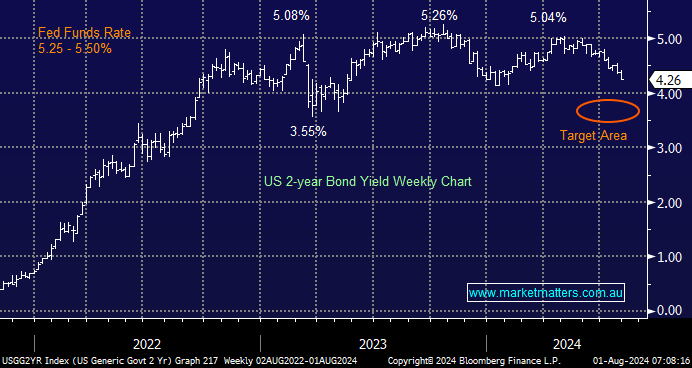

US bonds embraced Jerome Powell’s comments overnight, which should come as no surprise, with the 2-year yield approaching its 2024 low. A break below 4% is likely to herald a crescendo of optimism, a move which is just a matter of time, in our opinion.

- We continue to target a break below the psychological 4% area for the US 2s, but we’re conscious that the bonds are more than halfway towards their destination.