Nike is a stock we’ve had on the radar for some time, with our last note saying ‘NKE reports quarterly earnings this time next month, and we’ll be looking for evidence of growth in revenue in the quarter, and guidance for back-half acceleration. If they deliver, we’ll take a more positive view towards this iconic brand – until then, we remain in wait-and-see mode’.

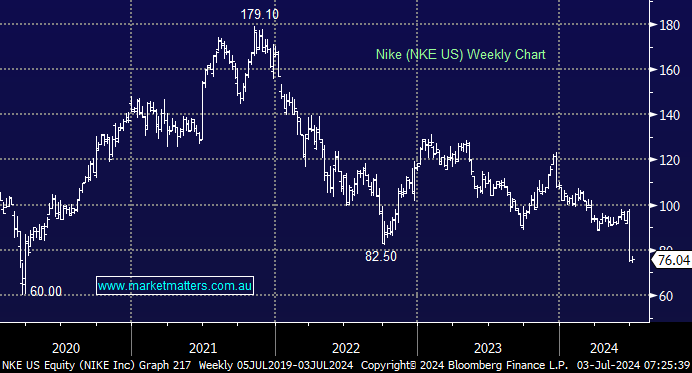

The quarterly was released, it was underwhelming, and the stock dropped 20% hitting a new 52-week low in the process. They painted a weak picture for fiscal 2025, now expecting a mid-single-digit decline in revenue, which is a significant change from previous growth projections. They guided to a 10% revenue drop in the first quarter, as sales are impacted by growing competition, though this is largely self-inflicted due to a change in their wholesaling policies.

The result was not what we were looking for, and it’s now obvious that NKE has a long road ahead to develop new products and regain the leadership it enjoyed in years past. While the competitive landscape has changed, making it easier for competitor brands to gain market share through less expensive advertising channels like social media (via influencers), consumer trends do change quickly, so there may well be a time we revisit NKE, but for now, we see no near-term catalyst.