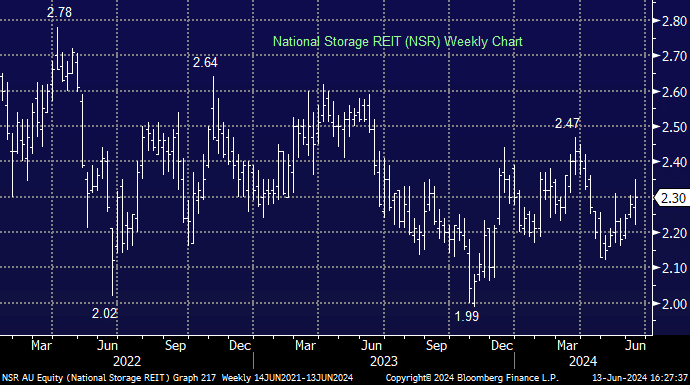

NSR +3.14%: the self-storage manager announced a JV with Singapore Sovereign Wealth fund GIC to develop an initial portfolio of 10 assets, with the partnership planning to deploy $270m within the next 18 months. NSR will own 25% of the venture but will act as the manager for the initial 5-year term. NSR will reap $120m from asset sales into the fund, helping to reduce debt. The deal shows plenty of interest in Australian storage assets and the announcement leaves the door ajar for a far bigger investment from the fund which controls ~$US750b.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Thursday 17th April – ASX +24pts, CGF, BHP, STO

Thursday 17th April – ASX +24pts, CGF, BHP, STO

Close

Close

Thursday 17th April – Dow -699pts, SPI down -26pts

Thursday 17th April – Dow -699pts, SPI down -26pts

Close

Close

MM is long and bullish NSR

Add To Hit List

In these Portfolios

Related Q&A

Thoughts on a2 Milk (A2M) and National Storage (NSR)

Thoughts on Aristocrat (ALL) and National Storage (NSR)

Update of MM’s Webinar – “Pulse check 7 Highest conviction calls”

How much further can real estate stocks appreciate?

REITS

Does MM have a preference between CNI and NSR?

MM updates on DXS, NSR and ABB

Which REITS have the most capital upside?

What are MM’s current thoughts on ABG/ASK and NSR?

What stocks for property exposure?

Relevant suggested news and content from the site

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Thursday 17th April – ASX +24pts, CGF, BHP, STO

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 17th April – Dow -699pts, SPI down -26pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.