Hi Chris,

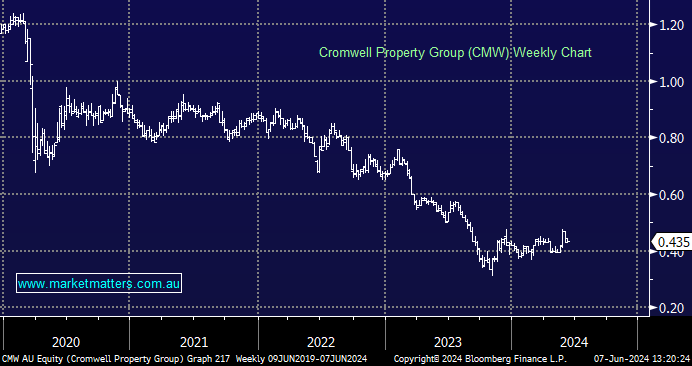

Cromwell Property Group (CMW) is a $1.1bn diversified real estate investor, which is only covered by two brokers who both have it as a Hold. The issue we have with CMW is the capital losses that have unfolded over the last few years while the attractive dividends were being paid i.e. a classic dividend trap.

After recent tough times the company has embarked on a strategy to simplify the business and transition to a capital light funds management model with a local focus. Last month they announced the sale of the European funds management platform and interests to Stoneweg for $457 million, a move which allows CMW to focus on its core competencies in Australia and New Zealand.

- The stock screens cheap and last quarter it was trading on 0.72c Book Value Per Share, but it’s not for us yet.