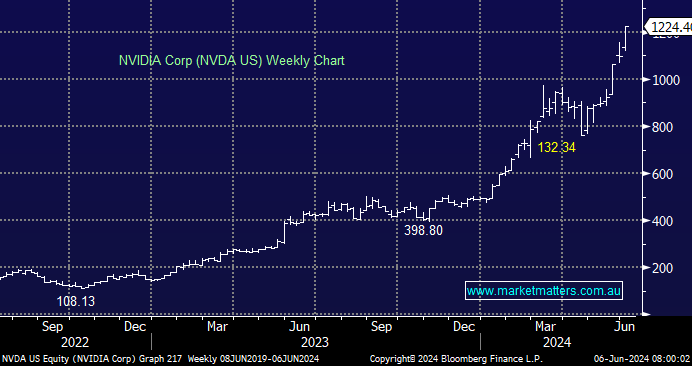

NVDA, with a market cap of $US3.012 trillion, has become the second-largest company after last night’s strong session, but in many people’s eyes, it’s now the most important company in the world. Their latest stellar report demonstrated growth beyond most CEOs’ wildest dreams, e.g. they guided to revenue of around $28bn in the 2Q25, up from around $11bn at the same time last year. We can’t help to requote their much-lauded CEO Jensen Huang’s statement which accompanied their latest quarterly: “The next industrial revolution has begun, AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.” – interestingly, at this stage, the energy side of the equation is being called into doubt.

NVDA already has an estimated 80% market share in AI chips for data centres, which are attracting billions of dollars in spending from big cloud vendors – a theme that has seen the likes of GMG and NXT surge on the ASX. For the most recent quarter, revenue in its data centre business, which includes its GPU sales, rose 427% from a year earlier to $22.6 billion, about 86% of the company’s overall sales, illustrating the growth in this relatively new area.

- We can see NVDA significantly higher into 2025, making optimum entry into this runaway train the key. While we have clearly been slow on this, one option is to buy now, leaving $$$ to average into dips, i.e., a potentially win-win scenario assuming the bullish outlook is correct.