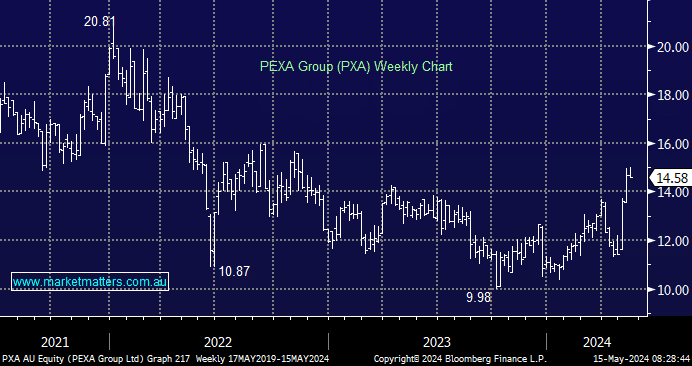

The digital property exchange and settlements system surged to 12-month highs during the week and is now sitting up ~25% in the last month, thanks to a bullish shift in sentiment. Before the shift, PEXA had been under pressure for several reasons:

- A new competitor pushing for market share in Australia

- Property & remortgage settlement volumes remain subdued, the expected rebound taking longer to play out

- A takeover of UK’s Smoove, considered a risky move at a time when the market was prioritising near-term earnings, PEXA had not yet proven its ability post the Optima acquisition in 2022.

Despite interest rates now expected to remain higher for longer (vs multiple cuts priced in for 2024 at the start of the year), the PEXA share price has surged. Volumes for the Australian business were down -0.7% in Q3 on lower refinance activity, however, the key transfer market has remained strong, up 9.1% in the quarter. Real Estate classifieds businesses REA Group (REA) & Domain (DHG) suggested listing volumes would continue to tick higher with momentum continuing into FY25 in their recent market updates.

More recently, the latest push from the stock has come on the back of momentum out of the UK. PEXA aims to gain a corner of the UK refinance and transfer market, funding the overseas growth from earnings out of the Australian arm. The acquisition of conveyancing technology provider Smoove gave them a boots-on-the-ground team with a small portion of the remortgage and property transfer market, helping to build out the group’s offering in the region.

PEXA also announced a partnership with NatWest, the UK’s fourth largest lender, to launch 48-hour remortgage transactions. The speed of settlement is almost unheard of in the UK, with remortgages often taking a month or more to complete while transfers usually take twice as long. This highlights the opportunity in PEXA’s platform, with a second lender also going through testing ahead of a potential deal.

- PEXA is the market leader in Australia and now starting to see traction internationally with a first-mover advantage