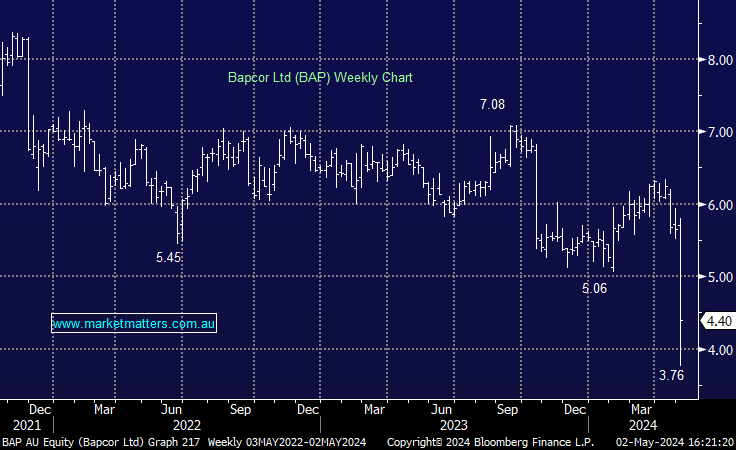

BAP -23.88%: the auto parts business hit 4-year lows today on its return to trade after a 2-day halt. The hit came in two parts. The company was expecting ex-Total Tool boss to start yesterday before he decided against joining Bapcor, 3 months after signing on for the job. The second was weaker guidance, now seeing FY24 profit of $93-97m as 2H numbers are now expected to be weaker than the 1H. The downgrade is ~18% below consensus expectations, driven by continued soft Retail trading, lower volumes and margins in Wholesale on increased competition, slower realisation of cost-out improvements and higher interest costs.

Likely the most concerning of the lot is the slowing Wholesale growth which was expected to be insulated from the cycles that are impacting Retail. The interim CEO, Mark Bernhard, will continue in the job while a replacement is found, however, the longer he remains in the seat the more concerned investors will be given the disappointing tenure so far.

- We see plenty of potential that isn’t being realized in this business, however, the near-term outlook is far more difficult to determine