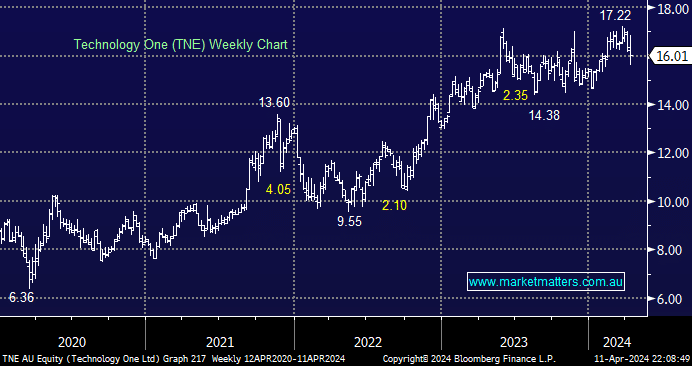

Software company TNE, unlike the previous three stocks, didn’t shoot the light out with its latest result, and it looks tired above $16. We continue to regard TNE as a high-quality growth stock, but it is expensive for the type of business it is, trading at almost 45x Est. FY24 earnings, a valuation that leaves plenty of room for disappointment.

- We have no interest in TNE in the $16-17 region on simple risk/reward around valuation.