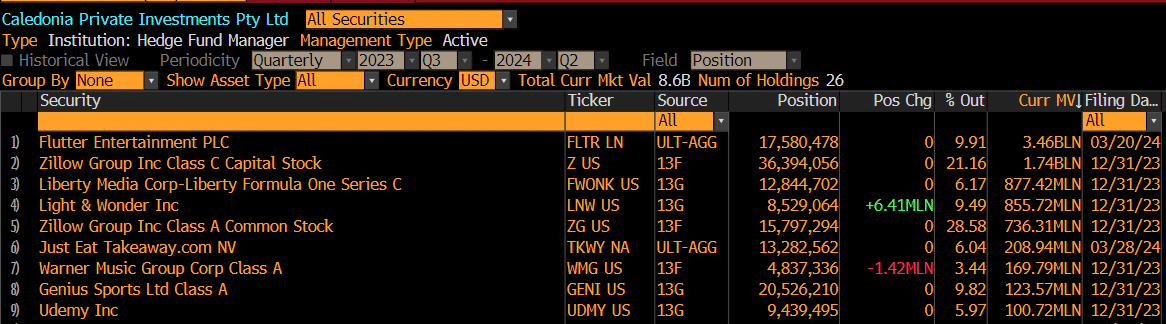

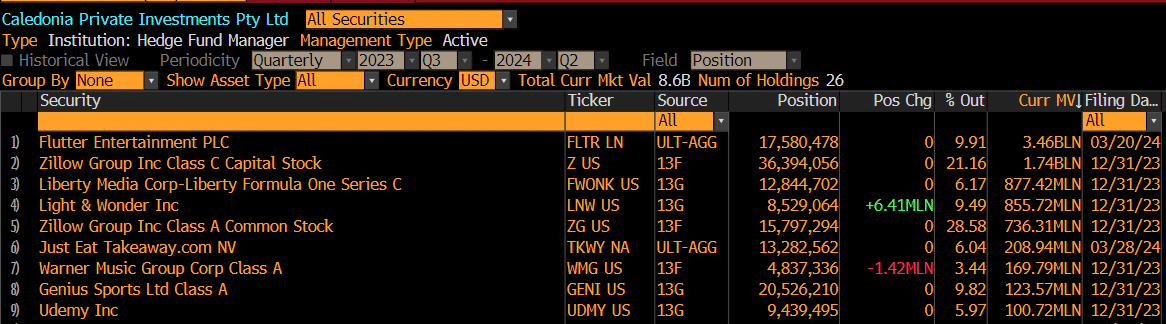

As the property market in North America improves, Zillow is a stock worth looking at. The stock has a storied past, its major shareholder is one of Australia’s largest hedge funds, Caledonia, headed by well-known billionaire Will Vicars. Will & Co employ a highly concentrated strategy, backing a handful of stocks in a meaningful way. ZG is their 2nd largest holding, worth ~$US2.5bn, although that is a very concentrated 28% of the issued equity of ZG, and they’ve backed it for over 10-years. There is a lot of media coverage on this, largely because it had dragged Caledonia’s performance in the past, while we also saw the Packer and Fairfax families follow the fund into the stock while Gretel Packer received Zillow shares from James Packer as part of an asset split after the death of their father, Kerry Packer, quite the history.

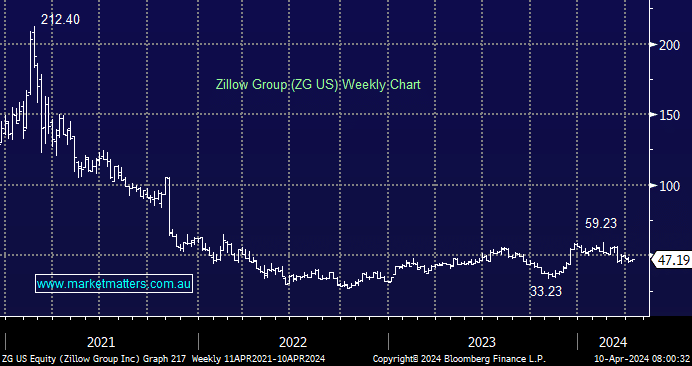

Zillow is a $US11bn company that is similar to REA Group (REA) but exposed to a much bigger North American market, which is a positive, although there is greater competition in the space vs Australia. They enjoyed a huge bump in share price during COVID, trading from ~US$20 to $220, but are now back down below US$50. ZG shares trade on 38x Est 2024 earnings, which are likely to be flat YoY, making it expensive this year; however, looking at the outer years from FY25 onwards, their earnings are expected to increase sharply, growing at ~40% pa based on consensus estimates. If the market is right on this, ZG shares will be trading on 19x by 2026, growing at very high rates.

UBS recently increased their price target to $US72 with a buy rating, and we think this view has legs. It’s been a very tough 2-years in property as higher interest rates have stifled transaction volumes at a time when ZG has been increasing investment in the business to position for when things improve. Interest rates are a big influence on property volumes in the US, and if they start to come down, as we think they will, volumes should increase and ZG is very well-positioned to capture this upswing.

- We are adding ZG US to the Hitlist for the International Equities Portfolio, a stock highly leveraged to lower interest rates. We note that they are scheduled to report 1Q24 results on May 1.