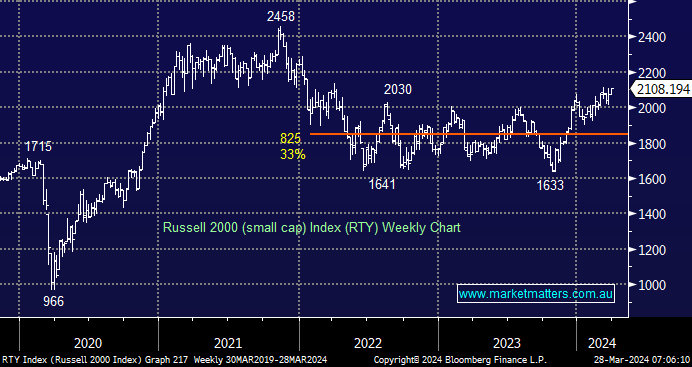

US stocks experienced a mixed session overnight, with the small-cap Russell 2000 index the standout performer, closing up +1.8% as a degree of performance rotation continues. The much-lauded “Magnificent Seven” struggled into Easter as it felt like some profit-taking was in the air, e.g. Nvidia (NVDA US) -2.5%, Netflix (NFLX US) -2.7%, and Meta Platforms (META US) -0.4%. Conversely, Merk & Co (MRK US) gave the old-fashioned index its biggest boost, gaining ~5% after the regulator approved its therapy for adults suffering from a rare lung condition. The blue-chip index is close to breaking 40,000 for the first time, and with the likes of Apple, Intel and Caterpillar also pushing ahead, it feels like a matter of time.

It was a good night for MM’s International Equities Portfolio, with lithium miner Albemarle (ALB US) surging 9% after announcing they sold spodumene for $1298/dmt in an auction, about two weeks before Pilbara (PLS) received $1200/dmt implying the market for Lithium is becoming more constructive for the producers. Also, First Solar (FSLR US) popped 9% on noticeably big volume in both the stock and call options.

- We believe US stocks are enjoying a bull market until further notice, but we’re aware that their seasonally weakest period is looming fast – most of us have heard of “sell in May and go away”.

The Yen hit a 34-year low yesterday, which led to Japan’s three main monetary authorities holding an emergency meeting late in Tokyo trading hours to discuss the weak yen and suggest they were ready to intervene in the market to stop what they described as disorderly and speculative moves in the currency. A weaker yen makes exports from the world’s fourth-largest economy cheaper, but it can push up prices of energy and other Japanese imports, fuelling inflation and raising the cost of living. The reaction by the currency to Finance Minister Suzuki saying they could take “decisive steps” against weakness was muted at best suggesting halting the move will take plenty of money.

- We are looking for a false breakout by the USDJPY, but how far it spikes on the upside is guesswork.