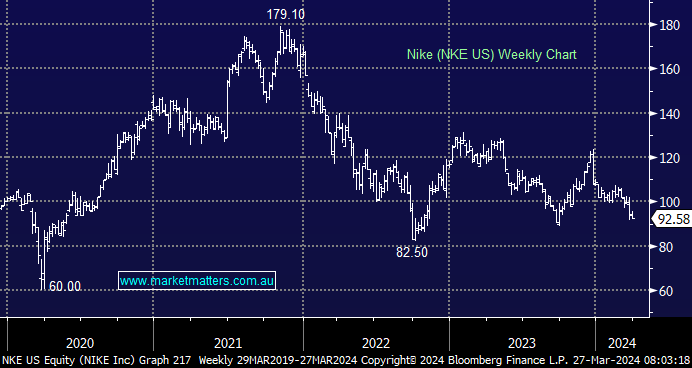

In January, we added Nike Inc. to the Hitlist of the International Equities Portfolio, saying at the time that while we like Nike as a business and the risk/reward is improving, we need to see tangible evidence of improved growth rates before agreeing with the generally bullish rhetoric that was being written/spoken about at the time (read the view here). Importantly, NKE needed to show signs that the current downgrade cycle had ended and the early stages of a turnaround were gaining traction.

Last week they reported Q3 earnings that failed to do that. The results themselves were okay, but business fundamentals are still challenging. However, more importantly, on the conference call following the release, they talked to further tweaks in their strategy in four key areas: 1) Bringing back the category offence and focus on sports; 2) Adjusting its direct-to-consumer (DTC) strategy; 3) Ramping marketing spend; and 4) Investing more in product innovation.

Point 4 is the interesting/crucial one because as it stands, Nike’s shoes are not resonating with consumers as well as they once did, and they need a new ‘good’ product to drive growth from here, but that comes with risk – it is simply very hard to forecast how successful new products will be. Their DTC model is also the reason why Nike has been a big winner over the years. However, it’s coming under some pressure as it reduces the flexibility in sales channels.

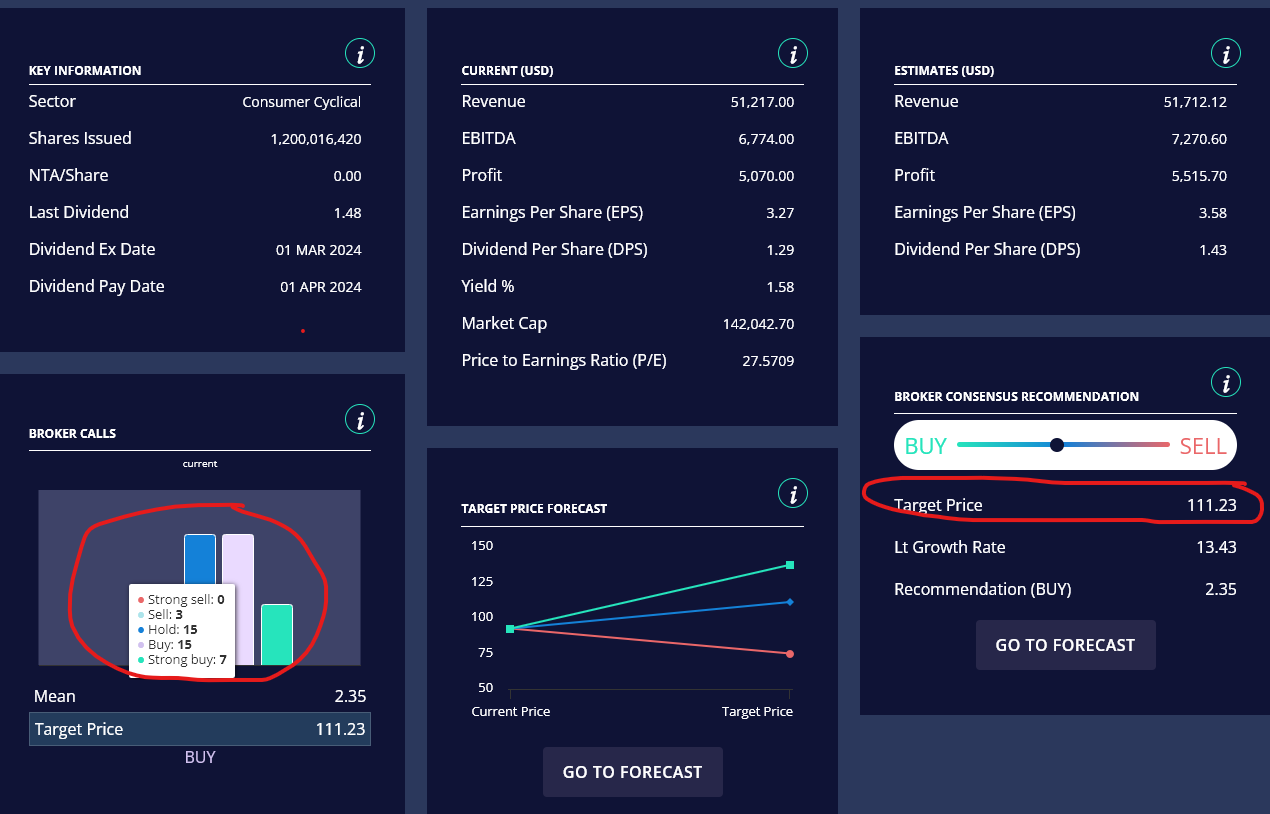

The market is favourable on Nike, with the company page on the Market Matters Website showing 22 buys from 40 analysts that cover the stock and a consensus price target of $US111.23, implying ~20% upside from current levels.

We’re now less positive on Nike in the short term and more in the wait-and-see camp. The four key areas covered above are aimed at driving better growth by the 2HFY25, however the timing of this is the risk. We also think consumer trends are notoriously hard to pick in the short term, and while Nike has been a phenomenal success story, adept at pivoting their brand over time, we think more water needs to go under the bridge before we step up and Just Do It!

- On an Est PE of 25x and only low single-digit sales growth expected over the coming 12 months, there is no rush to buy Nike.