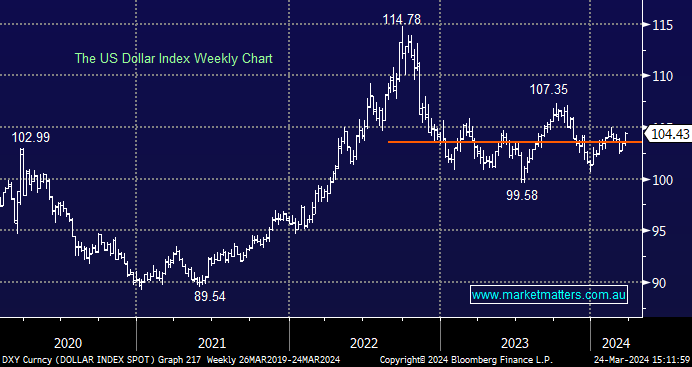

The Greenback found some support last week following the FOMC, and it surprisingly moved in the opposite direction to US bond yields. It appears the FX market focused on the pushback of rate cuts through 2025/6 as the US economic data remains strong. In a similar fashion to several other financial markets, the US dollar has consolidated over the last 18-months as it searches for direction, with a couple of false moves in both directions already under its belt.

- We remain net bearish on the US dollar, targeting a test and eventual break below 100 support.

The Yen weakened last week (USDJPY higher) after the BOJ raised rates for the first time in 17 years, i.e. a great example of news being built into markets. We’ve been looking for a breakout to new highs by the Dollar-Yen for months, with the move now feeling imminent; if we are correct, the question is how far will the spike unfold before we see a reversal lower – if MM is on point here and the $US is close to a period of weakness it will provide an encouraging backdrop for commodity prices.

- We can see the Spot Yen popping above 152 to fresh multi-year highs, but it’s a move we would look for catalysts to fade.