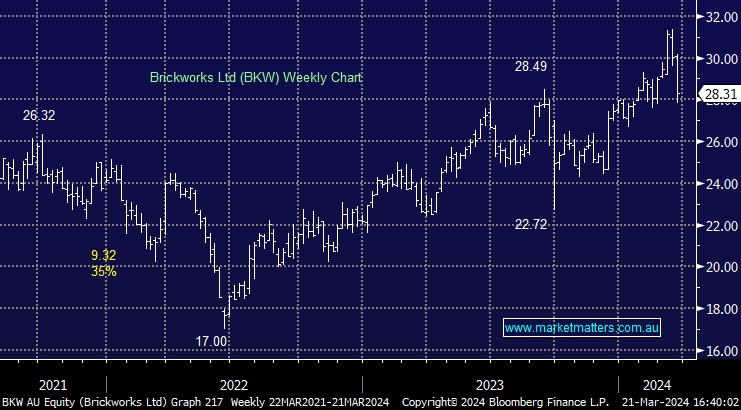

BKW –3.05%: Reported an underlying loss for the half of -$37m which was better than consensus of -$49m. Weaker property driven by negative revaluations and higher interest costs were offset by Building Products and Investments along with a lower tax rate. They raised their interim dividend to 24cps (vs 23c this time last year). Their outlook commentary around property was upbeat, saying “Australia appears to be on the cusp of a significant building boom” with “Construction activity forecast to increase in North America”. However, in the short term, strength in property will be offset by plant closures in the Building products business for maintenance, however, the medium-term trends remain solid.

- Recent weakness in BKW is starting to look interesting