Formerly Moelis Australia, MA Financial is an Australian Asset manager and corporate advisory business initially set up as the local arm of US Investment Bank Moelis & Company (MC US) with offices across Australia, Singapore & China. The group runs several strategies, including Private Credit, Real Estate and alternative finance within their Asset Management and Lending Arms, which runs alongside a Corporate Advisory & Equities division.

Recently, the group’s FY23 results were well below expectations, missing consensus expectations by around 10% at the profit line. Earnings fell 32% last year due to lower performance fees, particularly on their book of hotels under the Redcape banner. The underlying business, though, is performing well. Assets Under Management were up 18% in the year to $9.2b, with $1.9b of inflows primarily from Private Credit. Their recently launched MA Money Loan book has seen significant early success, growing to $829m. The Corporate Advisory division had a challenging year, though the backdrop was weak in that division, an area that will likely see activity pick up again in the near term.

Earnings were also impacted by ~$10m of investment into the business, with a similar level also expected in FY24. While a near-term headwind, MA has a strong track record of positive investment outcomes by putting its balance sheet to work and looking to drive earnings higher over the medium term. Overall, we see a reasonable underlying performance impacted by sector headwinds. The company is trading on 17.4x FY25 PE, dropping to 12.2x in FY26 due to strong earnings growth.

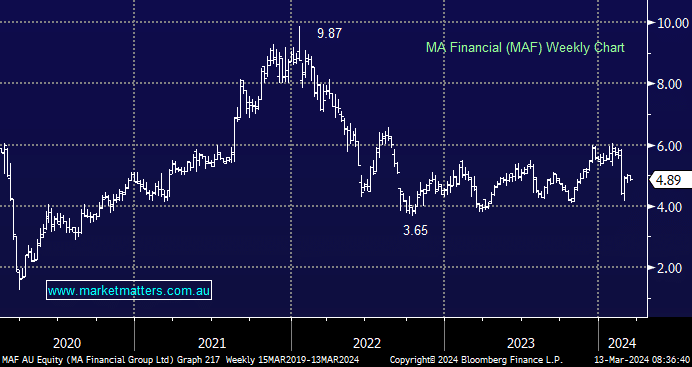

- We see value in MAF and expect the shares to rally on signs of easing headwinds that drive earnings growth over the next few years.