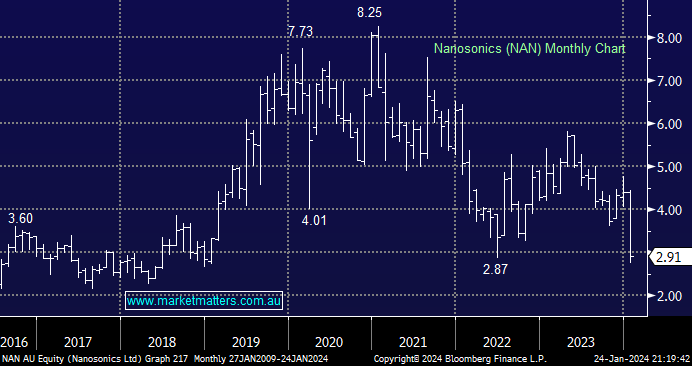

Disinfection device maker NAN plunged over 33% on Wednesday after missing sales guidance for the 6-months ended December 31st – we discussed the result in yesterday’s Match Out Report. NAN blamed hospital budget cuts for the decline in capital unit sales, which saw its 1st half-year profit significantly lower than a 12-months earlier, not ideal for a stock trading on 44x even after yesterday’s fall. As we’ve said a few times, with the market nudging all-time highs and stocks commanding high valuations, companies need to deliver through the reporting season or weakness will prevail.

- We have no interest in this $880mn company, we struggle to justify its current valuation even after yesterday’s aggressive downward rerating.