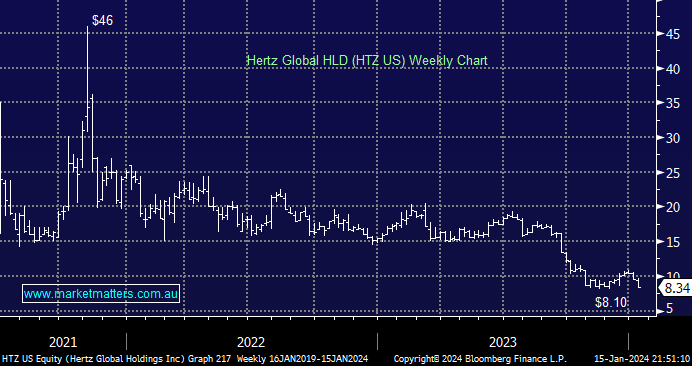

It was interesting to read in the last few days that car rental company Hertz was going to sell 30% of its US electric vehicles (EV), citing higher repair costs and diminishing demand for EVs – they are buying back the dreaded petrol vehicles! The rental giant hasn’t necessarily been a leading light over the last few years, with its shares falling in a bullish market. However, with increasing lithium supply, the commodity doesn’t want to encounter reduced demand for EVs or at least slower growth than is being priced in by markets. To put things into perspective, Hertz bought 100,000 Teslas in 2021, but the US isn’t buying into the EV story and the US accounts for well over 10% of the global car market.

- HTZ have said they are still committed to the EV strategy, but it will take longer to execute than was originally envisaged.

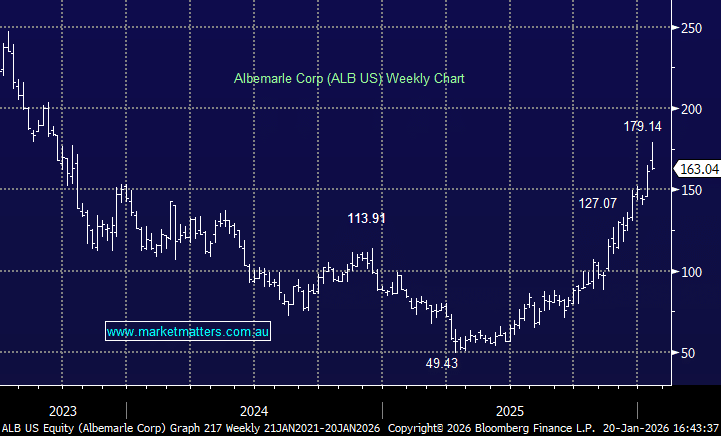

The lithium price has already plunged over 80% from its 2022 high, so negative sentiment is already priced into the commodity, with the big question being where’s the low. Many ASX investors are sitting on significant paper losses in the space, with heavyweight Pilbara Minerals (PLS) correcting 40% in the last six months while the traders are short to the gunnels across the sector, i.e. Pilbara (PLS) 21.2%, Core Lithium (CXO) 15.1%, and Liontown Resources (LTR) 8.3%. At MM, we’re not necessarily saying it’s time to buy today, but a downside washout may look appetising.

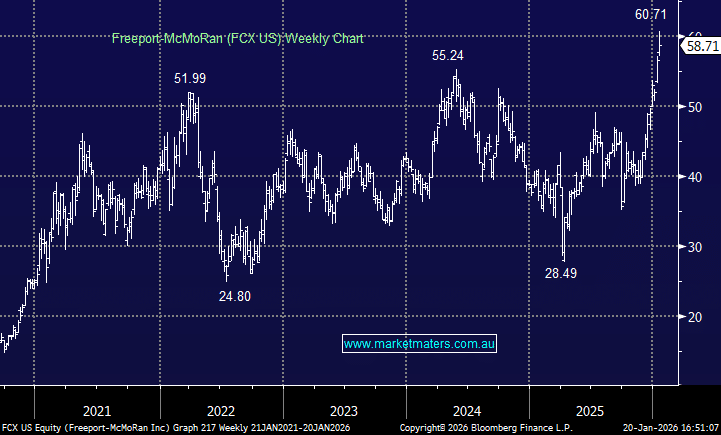

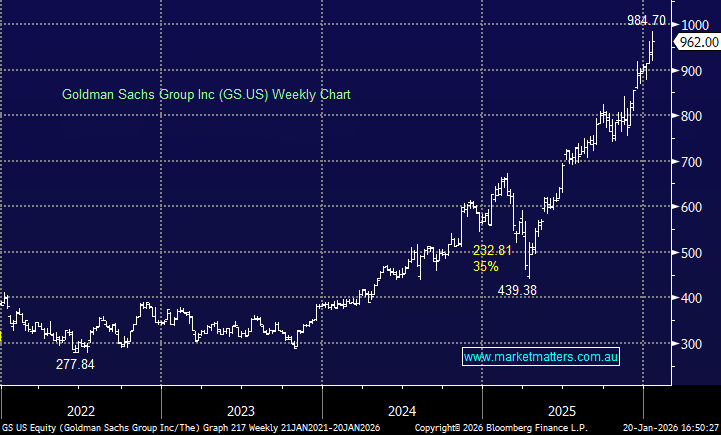

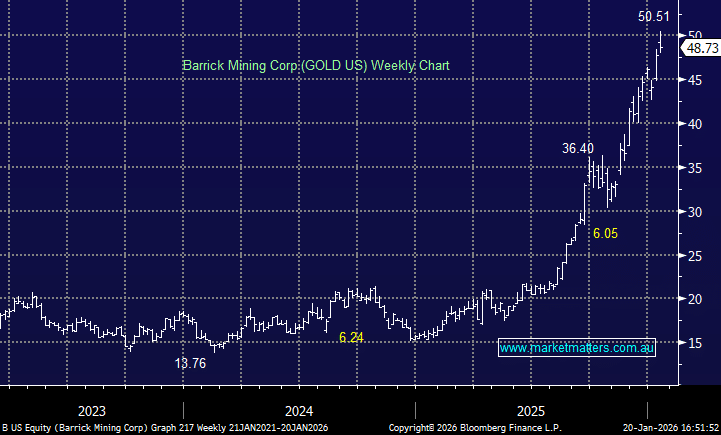

This morning, we’ve looked at four ESG stocks that have corrected significantly over the 6-12 months; our objective was to identify levels where the risk/reward will become compelling as we remind ourselves that catching a falling knife can be a dangerous game.