What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

RBA Governor Bullock probably doesn’t have a mortgage, but she believes that “households and businesses in Australia are in pretty good shape.” However, the market looks ahead, and the Australian 3-year bond yield has fallen below today’s cash rate as analysts look for cuts through 2024, albeit at a far slower rate than in the US. Ms Bullock said in Hong Kong on Tuesday that domestic price pressures have kept inflation more elevated than was expected, and in conjunction with Chair Philip Lowe, she basically said rates might still need to go higher to rein in inflation. Fortunately, she also said that the RBA needs to be careful with further tightening, but easing didn’t get a mention!

- Credit markets are pricing in a more than 10% chance of a hike in December, at MM, we don’t believe they will move.

Retail sales came in softer than expected in October, down -0.2% from September, missing forecasts of a 0.1% rise. We believe households are slowing their spending faster than many recognise, with the exception of the debt-free retirees who are enjoying today’s high-interest rate environment. Discretionary spending is declining into Christmas, we can see it “freezing over” in the New Year unless things change dramatically, i.e. the average person is simply paying too much in rent/mortgages before even considering the increased cost of fuel, food, etc. Importantly, there is a lag between rate hikes and behaviours, with the lag being impacted by savings rates or buffers, which have been high post-COVID. That means the lag has been extended, however, we think we’re now near the tipping point.

- We cannot see the RBA hiking again in the current cycle, but we believe it won’t be until 2H of 2024 that cuts are even entertained.

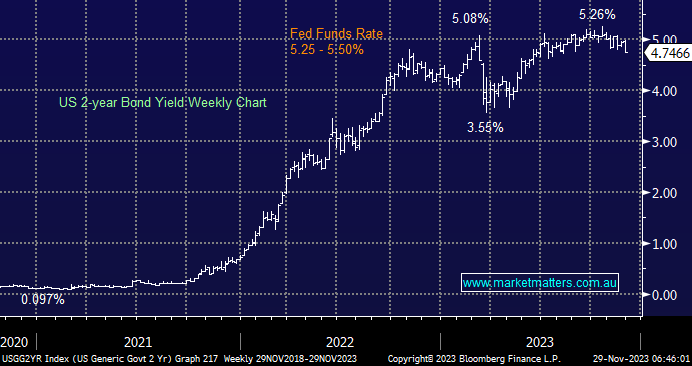

As mentioned previously, the US is embracing the prospect of rate cuts in 2024 with far more vigour than Michele Bullock et al.; interest rate differentials drive currencies; hence, if the $A doesn’t rally now, it never will! Our core outlook for bond yields is a concern for pockets of the market which benefit from strong economic growth.

- We can see US 2-year yields testing 4% through 2024/5, an exciting backdrop for gold, which popped another +1.4% overnight.

The ASX200 rallied on Tuesday, but again, it drifted lower through the session as buyers of strength remained conspicuous by their absence. The only major sectors to move more than 1% were Real Estate +1.48% and Energy -1%, with the oil stocks noticeably weak on the day, e.g. Woodside Energy (WDS) fell -1.6. On a more granular level, the gold stocks enjoyed a standout day, considering precious metals were quiet, e.g. Regis Resources (RRL) +5% and Emerald Resources (EMR) +4.8% – we remain bullish on gold and its related names into 2024.

The rate-sensitive Healthcare and Real Estate Sectors enjoyed every member on the main board closing higher, it’s not often you get 33 from 33! Michele Bullock may still be hawkish, but investors are slowly positioning themselves for a lower interest rate environment.

- This morning, the SPI Futures are pointing to a small +0.2% advance on the open with major gold players up ~5% in the US.