For subscribers unfamiliar with DTL, a less heralded ASX tech stock, it’s a value-added reseller of software and infrastructure products to government and enterprise customers in Australia. According to the company, it was Microsoft, Cisco and HP’s no.1 reseller in Australia and a top-five reseller for Dell in sales terms in FY23. We like DTL’s durable earnings growth supported by defensive revenue underpinned by term-based software and services contracts (65% of sales recurring), solid balance sheet and strong cash conversion due to its working capital-light model, but it’s not cheap, around $8.

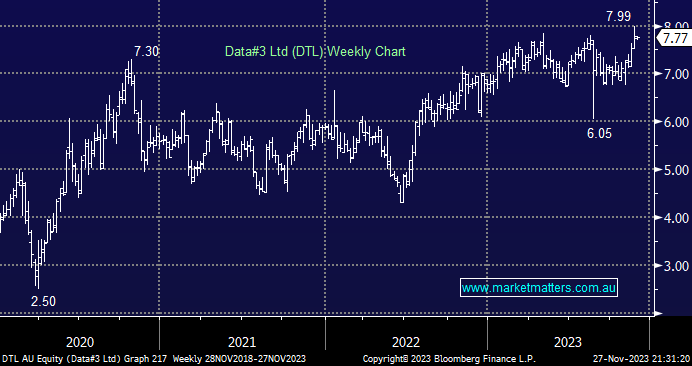

- We like the risk/reward on DTL closer to $7, as opposed to the current $8.