Hi All,

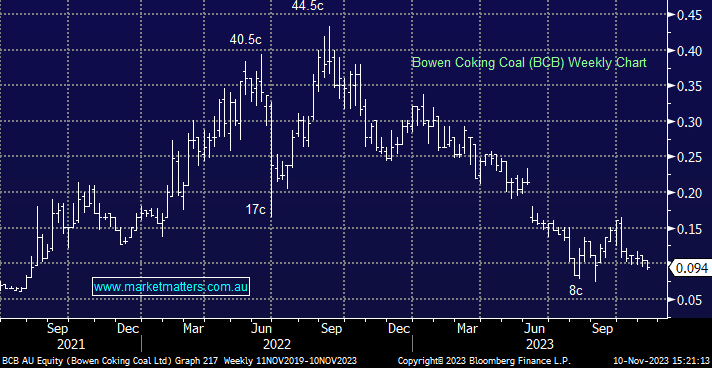

Bowen Coking Coal (BCB) has been a terrible investment, and it seems like anything and everything that could go wrong in a small emerging producer has happened for Bowen. They have travelled a very similar path to other junior resources that are entering production (Strandline STA springs to mind), highlighting the complexity and risk in this part of the market. At a high level, we stress the importance of positioning sizing in these high risk stocks. Our own Emerging Companies Portfolio had an initial 4% weighting which has more than halved, meaning the current weighting is less than 2%. We are inclined to take up the rights at 9c (v 9.5c last) which would increase the position by around ~0.6%, based on the 1 for 6 entitlement.

What has really hurt BCB was the delay in shipments which put their balance sheet under pressure. They had a loan facility with Taurus drawn to around US$50m and a A$70m facility with New Hope which was drawn to around $55m. Both these where coming up for maturity and they needed to be renegotiated – which they have been – to give some breathing room (albeit on less favourable terms). This $50m equity capital raise should give them more of a buffer and room to ramp up sales. Our understanding is the capital raise was well supported and it’s a positive to see Hans Mende, a well known Coal investor buy in.

That said, they last raised capital only 5 months ago at 17c, and they are now tapping the market at 9c, clearly a poor outcome. While we clearly wish BCB was not in the portfolio, and throwing good money after bad is not our usual approach, in this instance, we’ll likely have one more crack at BCB at 9c and see if they get it right this time around – the potential upside from these levels is high if they can execute their plans – something that has proven elusive in recent times.