Hi Peter,

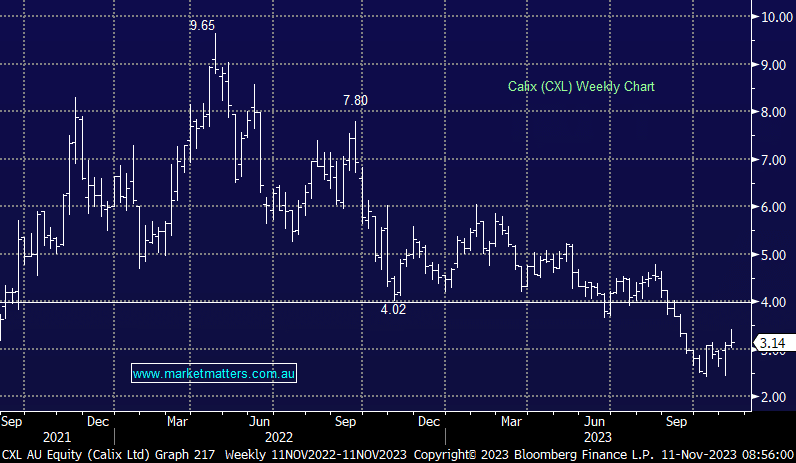

For those note familiar with Calix (CXL), it is an emerging environmental technology company that is developing a range of environmentally friendly solutions for industry, that are derived from its patented minerals processing technology, the Calix Flash Calciner (CFC).

The agreement you highlighted is another incremental step in their evolution, at a high level it provides third party validation of CXL’s Leilac kiln technology from a credible leader and pioneer in the space, backed by well known/credible investors like Bill Gate’s Breakthrough Energy Ventures fund. By executing the agreement, it also formalises the second royalty scheme to be applied for use of Leilac kiln technology, which is beyond the scope of the first commercial agreement with Heidelberg Materials, announced back in October 2022.

We think CXL is an exciting company, operating in an exciting area and while all this sounds good, it all costs money. Calix needs near-term revenue, something this agreement is unlikely to provide and puts further pressure on a strained balance sheet. We think there is a high chance that CXL could look to raise, or at least, tap partners for a capital injection. Any potential raise is not specific to this recent deal which is structured so Calix don’t have to tip in a great deal of capital, though their other projects may need an injection before significant revenues are realized.