What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The worst October in five years has seen active money managers cut their equity exposure to its lowest level in more than 12-months as the trifecta of bad news continues to weigh on stocks. The US S&P500 has already fallen by more than 1% on five occasions in October, and we still have two sessions remaining. With Apple reporting on the 2nd of November, next month also looks likely to start with ongoing elevated volatility.

- It is now over three weeks since we first saw pictures of Hamas attacking Israel, equities hate uncertainty, and how the current conflict in the Middle East will ultimately be resolved remains very hard to foresee.

- Inflation data has remained stubbornly strong through October, sending bond yields soaring to fresh decade highs and term deposits paying ~5%, creating real competition for investors’ funds.

- The US reporting season has been a mixed bag, with disappointing results being dealt with extremely harshly. For example, last week, we saw Alphabet (GOOGL US) -9.5% and Chevron Corp (CVX US) -6.7% after reporting.

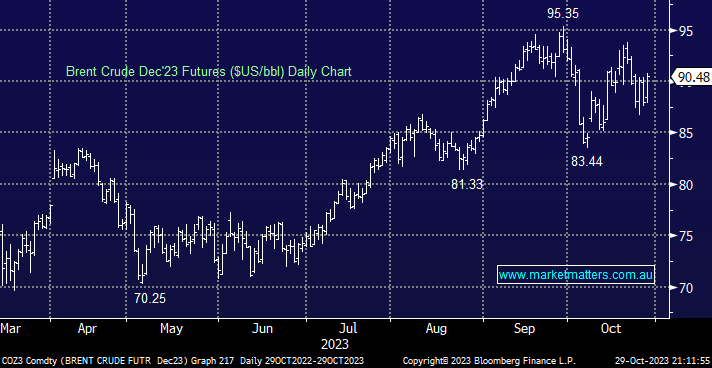

The last fortnight has seen stocks fall into Friday afternoon, which is no great surprise as 48 hours is a long time for markets to be closed when war is raging in a region that largely dictates the oil price. However, interestingly, on Friday, while the oil price jumped +2.9%, the US Energy Sector fell –2.3%, led by Chevron (CVX US) and Exxon Mobil (XOM US) after they delivered a big miss with their quarterly earnings – if they can’t deliver now when will they perform for investors?

- Crude oil has traded sideways through October, which should concern the bulls considering the escalating Middle East war, which unfortunately has no end in sight.

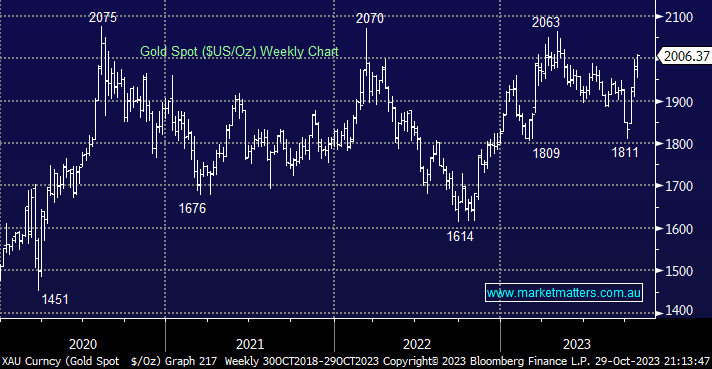

Gold surged above $US2,000 last week due to increasing geopolitical risks, illustrating the lack of reaction by the oil price, even as risks increase that the Israel-Hamas conflict may spread across the region. In $A terms, the gold price remains in the $A3150-3200 region, its highest level in history courtesy of a weak Aussie Dollar, all the Gold Sector needs now is a pullback in bond yields and the related stocks should surge higher.

- If/when we see a pullback in bond yields, the gold price will be a significant beneficiary.