Hi Brett,

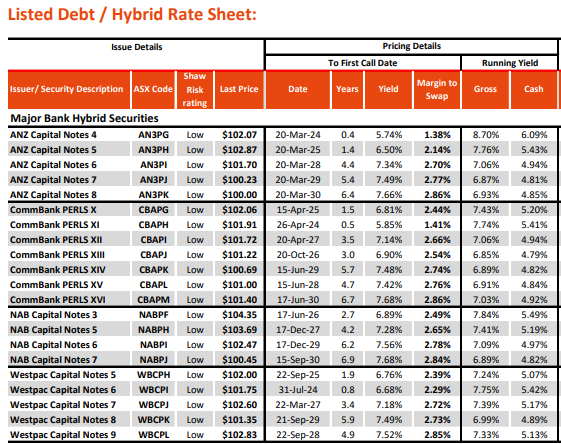

When we buy a hybrid, we essentially lock in the margin that is offered out to the first call date. All things being equal, longer dated hybrids should have higher margins to compensate for the added risks associated with longer durations. That is generally the case when thinking about new issues. Using the examples of CBAPL and CBAPG you mentioned, CBAPL is currently trading on a margin of 2.76% with 4.7 years to run – they were originally issued at 2.85% over BBSW. The CBAPG which only has 1.5 years to first call is trading at a margin of 2.44%, so there is a difference.

We agree that shorter hybrids look solid here and the reduced trading margin is fairly small. The one consideration is that if spreads narrow further, a new hybrid being issued (rolled) will come on at a slimmer margin, which will impact the holders of the shorter dated securities, while those holding longer dated paper will continue to get a higher margin, the same is obviously true on the other side of the coin.

When we manage hybrid portfolios, we generally like to layer duration, and have a nice blend of maturities rather than skewing one way or another.

Right now, the following securities are screening well:

Short Dated (<3 Years): WBCPI; CBAPG

Mid Dated (3 -5 Years): WBCPJ; WBCPL

Long Date (>5 Years): AN3PK; CBAPM