The $US rallied last week, enjoying its usual safety bid as tensions grow in the Middle East. In the short term, it’s tough to guess the future direction of the Greenback, but our longer-term view is aligned with our outlook toward bond yields.

- We remain net bearish towards the $US, but the short-term war in Israel will likely keep the Greenback firm.

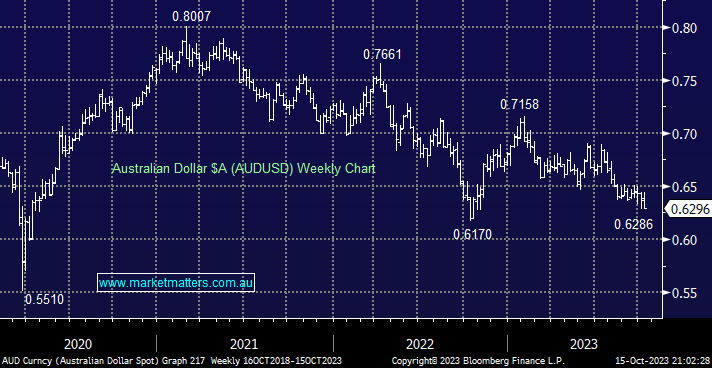

The commodity and growth-focused Aussie Dollar has struggled over recent years as investors have become increasingly concerned that a recession is inevitable after this century’s most aggressive tightening cycle. Plus, China is struggling to kickstart its economy after its failed COVID zero policy. The bearish trend remains strong, and a break below its 2022 low looks like an increasingly strong possibility – not good for overseas holidays.

- The downside momentum could see the Aussie test the psychological 60c into 2024.