The Australian three-year bond yield edged back below 4% last week and we’re set to open unchanged this morning, but events unfolding around Israel could see them marked lower this morning as the appetite for the relative safety of bonds increases, i.e. higher bond prices mean lower yields.

- No change; we continue to look for Australian short-dated yields to re-test 3% in 2024.

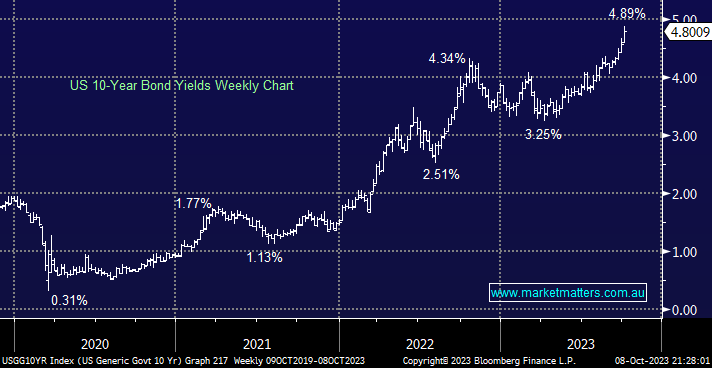

Longer-dated US bond yields surged higher last week as markets embraced interest rates being “higher for longer”, but the awful situation unfolding around Israel could change the dynamic with a few forces at play – from a yield perspective, a higher oil price will be inflationary and bullish but a bond “safety bid” and potential global economic slowdown courtesy of higher oil prices is bearish. In the short term, we believe the “safety bid” will be the predominant factor.

- We believe the US 10-year bond yields will struggle to push through 5% for the foreseeable future.