What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

A number of times over recent months, we’ve been looking for some stock/sector reversion, but it has proved elusive as bond yields continue to make fresh multi-year highs, ultimately leaving most of 2023’s trends intact, e.g. an underperforming Healthcare Sector while Tech heads the winner’s enclosure. More on this later when we put the increasingly influential bond yields back under the microscope given our views are being challenged. However, on the commodities front, especially in the clean energy space, we’ve seen some huge performance differentials that have little to do with bond yields.

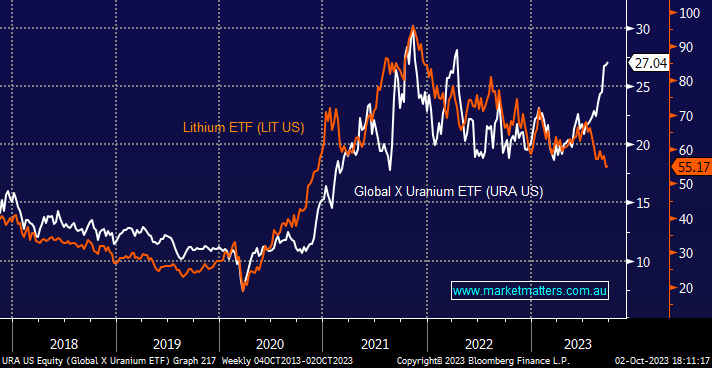

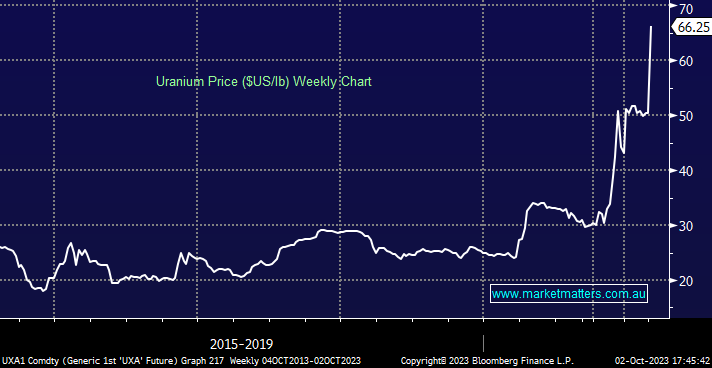

- The uranium price has more than doubled in the last two months. At MM, we were bullish on our Resources into FY24 webinar, but this aggressive move has surprised even us.

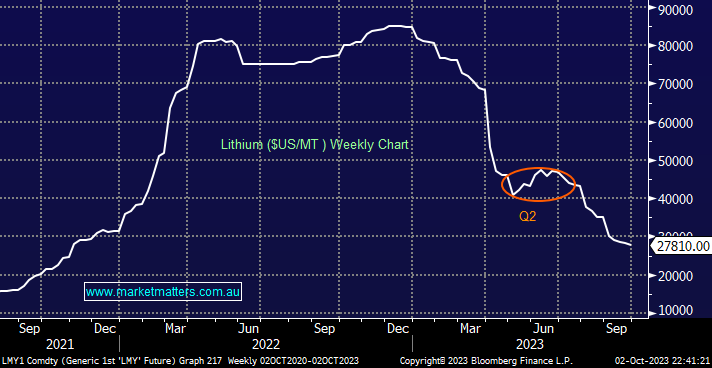

- Conversely, the Lithium price has plunged by over 60% in 2023, just when EVs are becoming increasingly common on the roads.

At the start of this year, many investors thought portfolios should be heavily skewed towards clean energy, and lithium was usually the commodity of choice, followed by copper, with uranium not on many investors’ radar. It’s easy to stand back and contemplate this elastic band snapping back sooner rather than later and reweighting portfolios accordingly, but we take readers back to the first paragraph today:

- Trends in 2023 have kept going longer and further than most people expected.

The collapse in the lithium price has dragged down the related stocks even with plenty of M&A bubbling away beneath the surface, although interestingly, investors’ enthusiasm for the sector has returned in a major way whenever the commodity enjoys a meaningful bounce, e.g. Pilbara (PLS) bounced over +60% when lithium enjoyed a relatively minor recovery in Q2 of this year.

- We believe lithium stocks are starting to offer value, but our preference is for the profitable and dividend-paying majors.

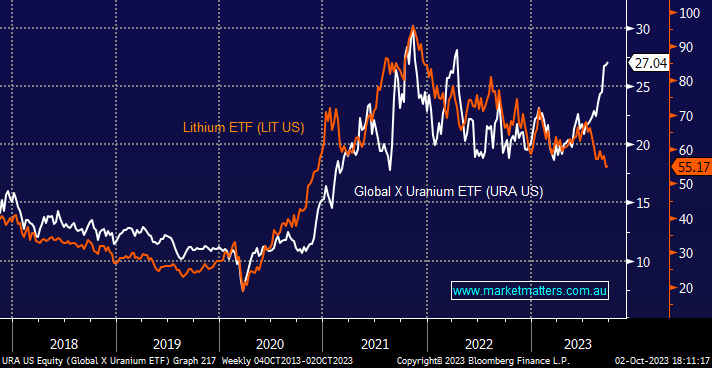

The respective uranium and lithium ETFs have tracked as would be expected, although it’s interesting that the uranium ETF is still ~10% below its late 2021 high, suggesting to us that the sector can push higher although, as we said earlier, a period of consolidation is overdue.

- We believe it’s time to slowly starting to consider a reweighting back towards lithium names in Q4 of 2023.