What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

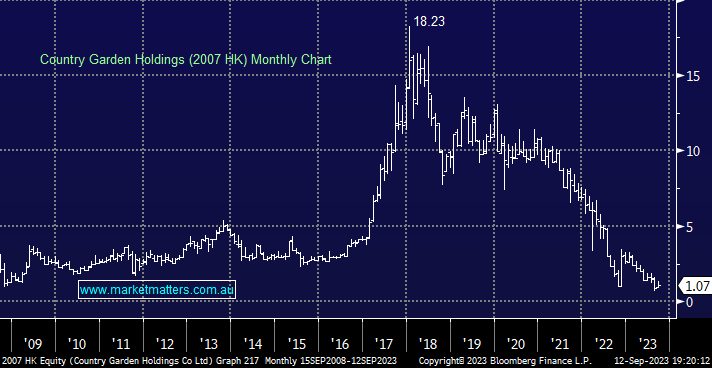

A lot has happened across financial markets post-COVID, with China’s former largest builder an unsettling example of what can go wrong when geared investments turn south, in this case, China’s property market. Country Garden has tumbled well over -90% from the dizzy heights achieved in early 2018, illustrating that all markets are cyclical, even property in a country like China where investors are obsessed with the asset class – dare we say sound familiar? Reinvigorating the property market has become one of Beijing’s most important steps to lift its struggling economy post the strict zero-COVID policies, one which will, by definition, improve consumer sentiment.

Shares in Country Garden rallied yesterday after the developer won approval to extend repayment on six of its yuan bonds by three years. Although it may potentially just delay the inevitable, it does at least offer some hope – the company’s dollar bonds are still trading at around 10% of their face value, illustrating the market’s scepticism that holders will eventually be reimbursed with their original investment. Country Gardens fall has unsettled investors with it having been a household name famed for building homes in smaller cities, but even the country’s previously richest women has not been able to navigate the country’s property debt crisis.

Country Garden is now China’s 6th largest developer, although it remains closely watched because further defaults could roll through the sector in a similar, if not worse, fashion than when China Evergrande failed– Beijing can ill afford to see another significant failure. We don’t regard the sector as investable, but we wouldn’t be surprised if the worst is behind the stock.

Over the last week the economic news out of China has improved although similar to the share price of Country Garden it’s only a glimmer of hope at this stage. However, many resources stocks have started to “look & feel” more robust, with iron ore defying the bears and rallying more than +20% over the last month. In our opinion, the big miners, like BHP & RIO, aren’t fully embracing the recent move in the bulk commodity, let alone pricing in the potential that it could sustain its advance.

- We can see the Materials index breaking its 2023 high into 2024, led by market heavyweight BHP – the “Big Australians” revenue currently comprises 48% iron ore, 31% copper and 21% coal.

- The consensus view is iron ore will be lower over the coming year with UBS at ~US$100 for FY24 and $US80t for FY25 compared to the current spot price above $US120/tonne – imagine if China starts firing; it will be upgrade central!

The ASX200 again recovered from early weakness to close up +0.2% although we still saw more stocks decline led by the Energy Sector although the market appears to have got this one wrong following crude oils pop over $US91/barrel last night. This morning may see many short-term players hang on the sidelines ahead of this month’s important inflation data out of the US, the interpretation of which along with next week’s FOMC meeting is likely to set the tone for bond yields over the coming weeks.

- This morning, the SPI Futures are pointing to a weaker opening by the ASX200 down -0.3%, with BHP down 25c in the US, plus weakness in tech, likely to weigh on the index early.