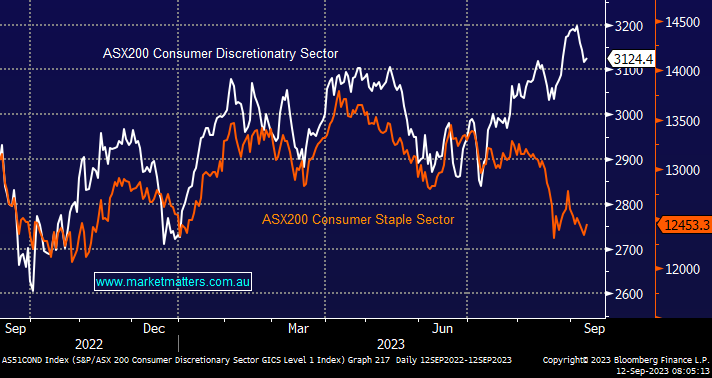

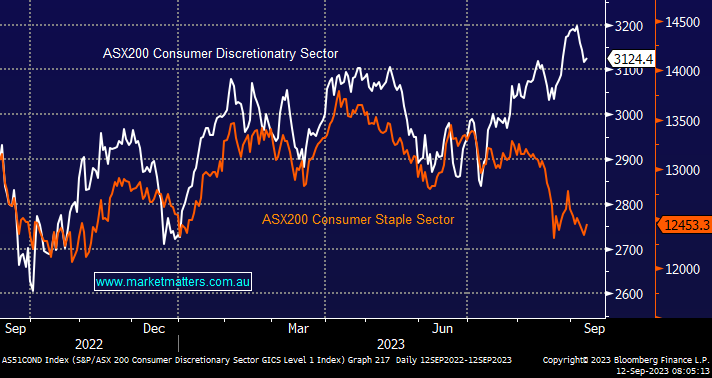

Arguably the biggest surprise to the market through August came from consumer stocks. Into reporting season investors had been “hiding” in the perceived safety of the defensively regarded staples, assuming that the discretionary stocks would struggle under the increasing weight of cost-of-living pressures, including higher mortgage rates. However as is often the case the crowd is wrong, with consumer spending only slowing after markets had priced stocks for far worse. Conversely, the crowded staples suffered from increasing cost and operational challenges.

- We believe the Consumer Staples basket is starting to present value – we own Metcash (MTS) in our Active Income Portfolio, and continue to see this as a buy at current levels.