Spark (SPK) is slowly changing from a legacy telco to a mobile and data infrastructure company, over time these business units could contribute over 70% of SPK’s profit – undoubtedly a hot space in today’s market. This month saw SPK report FY23 EBITDA of $1.193bn which was above the bottom end of the guidance range of $1.185bn while their FY24 EBITDA guidance range of $1.215bn to $1.260bn implies EBITDA growth of 2-6% which was in line with consensus of $1.23bn.

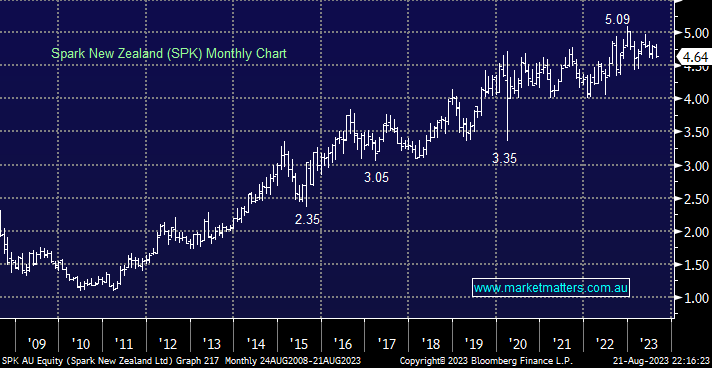

- We like SPK but the risk/reward isn’t overly appealing closer to $5 than $4.