What Matters Today in Markets: Listen Here each morning

The week is only 2 trading days old and we’ve already seen significant moves by two central banks but in completely opposite directions, although neither has been interpreted particularly well by stocks:

- China’s PBOC cut their medium-term lending facility from 2.65% to 2.5% and the reverse repo rate from 1.9% to 1.8% i.e. rate cuts to stimulate a lacklustre economy.

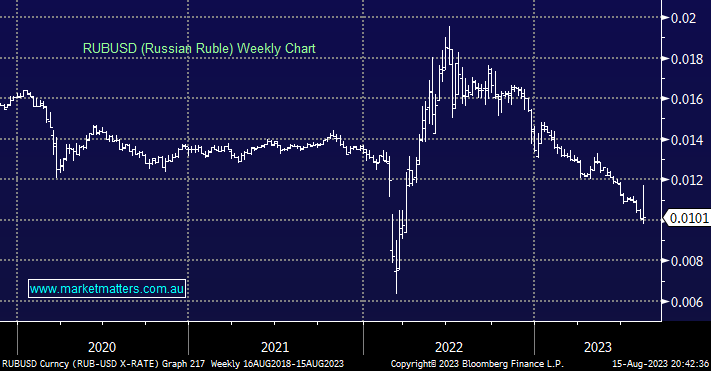

- The Bank of Russia jacked up interest rates from 8.5% to 12% in an effort to support the Ruble which had fallen to its lowest level in 16 months – the RBA doesn’t look too bad in comparison!

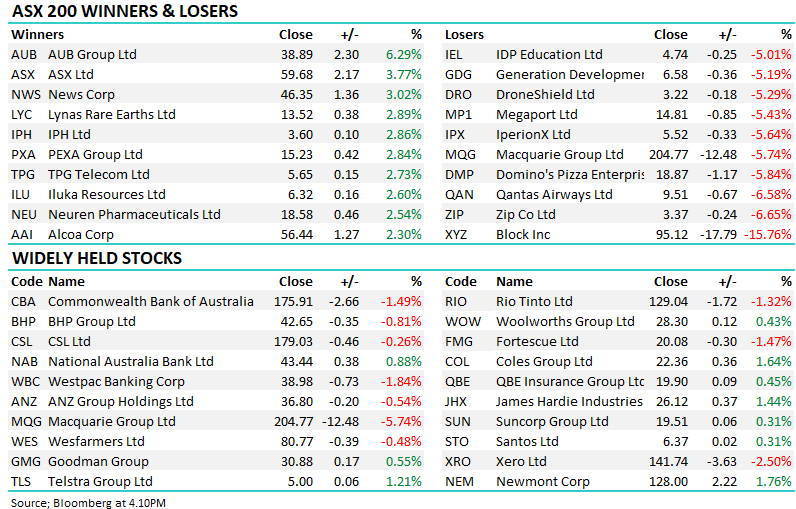

The initial reaction to the stimulatory move by the PBOC was positive with resource stocks in particular reversing early losses e.g. BHP Group (BHP) rallied +50c from its lows but by the close it had surrendered half of the move to end down -0.3%. The move by the PBOC came in as China suspended reporting youth unemployment rates from August, that’s one way to hide souring numbers. In our opinion, the Politburo, China’s prime decision-making body, will need to pull more levels to turn around their juggernaut economy and consumer sentiment.

- However, we believe China will successfully kick start their economy through 2023 with a number of targeted initiatives on top of rate cuts as opposed to a more traditional bazooka-like approach.

- At this stage of the cycle markets are unconvinced that China is doing, or indeed can, do enough e.g. after European markets opened last night the copper price had fallen -1.8% on demand fears.

US futures traded lower as Europe opened following the disappointing retail sales and industrial production data out of China with the rate cuts appearing to elevate concerns around their emerging property crisis. This weakness followed through into the US session with BHP falling another -70c on the ADR market illustrating that markets are continuing to get increasingly concerned about China moving forward.

Similarly, pressure has been mounting on the Russian economy as the cost of war takes its toll in many ways, a depreciating Ruble is inflationary with imported goods costing more but we don’t believe this rate hike will renew the market’s interest in the currency, in simple terms, that will need peace.

The Chinese Yuan fell to levels not seen since November 2022 illustrating the tricky balancing act facing the PBOC however we can see an end in sight to the 18-month sell-off. We’ve now seen two rate cuts since June but confidence is actually deteriorating following the news from Chinese property developers, patience toward accumulating resource stocks looks likely to pay further dividends.

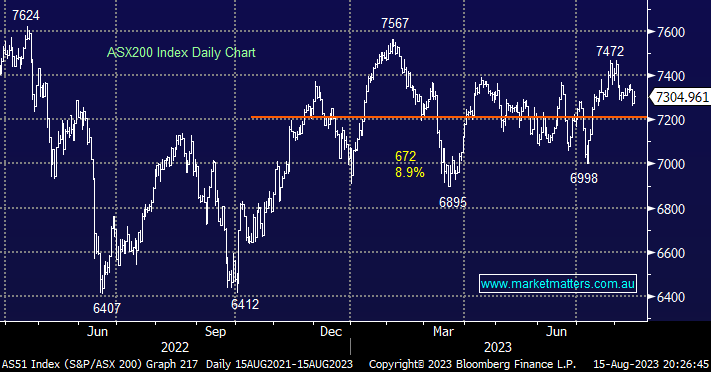

The ASX200 rallied on Tuesday with sentiment buoyed by the PBOC rate cut – the optimism dissipated through the afternoon before vanishing as Spain kicked a phenomenal goal to break the 1-1 deadlock with Sweden. There were some interesting names on yesterday’s leader’s board including GUD Holdings (GUD) +14.9%, Life360 Inc (360) +12.3% and Sims Metals (SGM) +6.2% illustrating the relatively unpredictable nature of reporting season. Macro news might be influencing the swings on the index level but it’s good old earnings that’s dictating moves on the stock level.

- The SPI Futures are pointing to a -1% fall this morning following weakness on Wall Street and the -1.6% dip by BHP in the US.

- Following the negative lead from the US and commodities markets losses are likely to be led by the resources and energy names.