Ongoing weak economic data out of China has weighed on commodity prices and by association our miners over recent weeks/months as the much anticipated bazooka of stimulus out of Beijing remains absent. Yesterday we heard further bad news from their ailing property sector, one that’s illustrating that all asset classes are cyclical at times:

- Real Estate developer Zhongzhi Enterprise Group delayed payments to three of its clients raising liquidity fears in the country’s ailing economy and the resulting demand for iron ore.

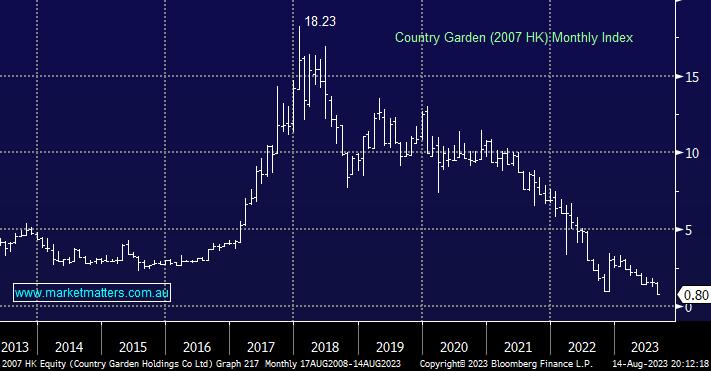

This news compounded the announcement last week from Country Garden Holdings, another of the nation’s largest developers, who reported steep losses in the first half of the year while adding it would suspend trading in several onshore bonds i.e. it could endure a whopping $US7.6bn loss for the first 6 months of the year. A quick glance at Country Garden’s share price shows it’s been on the skids for years, yesterday it closed down another 18%, a whopping 95% below its 2018 high. To put things into perspective Country Garden has four times more housing projects than Evergrande did when it defaulted in 2021 – Moody’s has recently downgraded its rating to Caa2 i.e. very high credit risk. If China can reinvigorate its slowing urbanisation and declining birth rate the developers will be a beneficiary.

Beijing has undoubtedly got its work cut out, July’s CPI fell by -0.3% year on year while the PPI fell -4.4% over the same period, the 1st time both numbers have been negative since November 2020 when COVID was the only story in town hence the deflation concerns are real and well-founded and MM firmly believes Xi Jinping et al must step up. However, it’s not all bad news with Chinese household savings continuing to rise illustrating that a significant part of the issue is consumer confidence which can be reversed with the appropriate action.

- We continue to believe that China will stimulate its economy through 2023 but when it’s good and ready, not necessarily to appease markets.

- Xi Jinping has emphasised the need for high-quality growth hence we anticipate moves will be measured but eventually successful.

Overall we believe the issues within China’s economy have been building for years with COVID simply the catalyst hence the cautious approach by Beijing to turn this wayward ship around, it simply needs to be done properly.

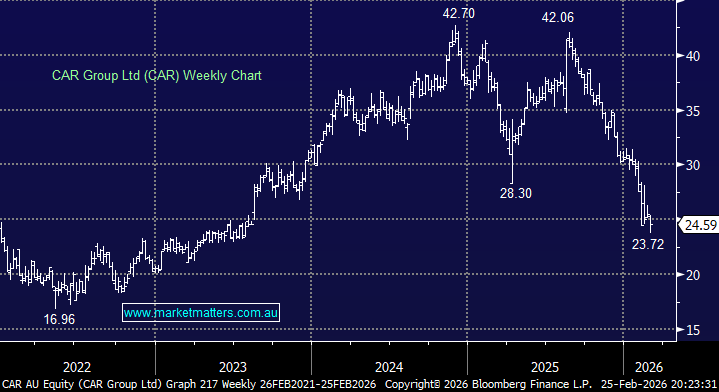

This morning we have revisited 4 China facing ASX commodity plays as we actively consider when to start increasing our exposure to the Resources Sector:

- We deliberately didn’t look at South32 (S32) simply because there’s no change to recent notes i.e. we like S32 into current weakness hence it remains in our Hitlist – S32 reports on the 24th.