What Matters Today in Markets: Listen Here each morning

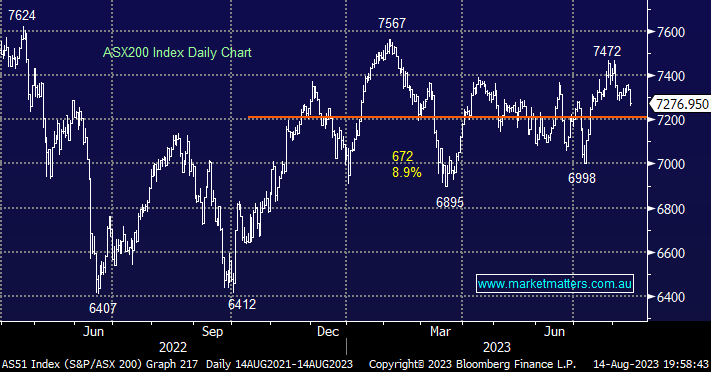

The ASX200 commenced the week with a -0.9% fall courtesy of escalating concerns that the Chinese property sector was again on the precipice after shares in one of their largest real estate developers missed bond payments casting doubts as to their liquidity and potential contagion throughout the sector. We will focus on this issue later in today’s report but the local index wasn’t immune from a wave of selling that swept the region e.g. Hang Seng -1.6% and Japan’s Nikkei -1.3%. As subscribers know markets often hate uncertainty more than bad news and with Retail Sales, Unemployment and House Price Index all due out of China over the coming 24 hours, it was a clear case of if in doubt stay out on Monday.

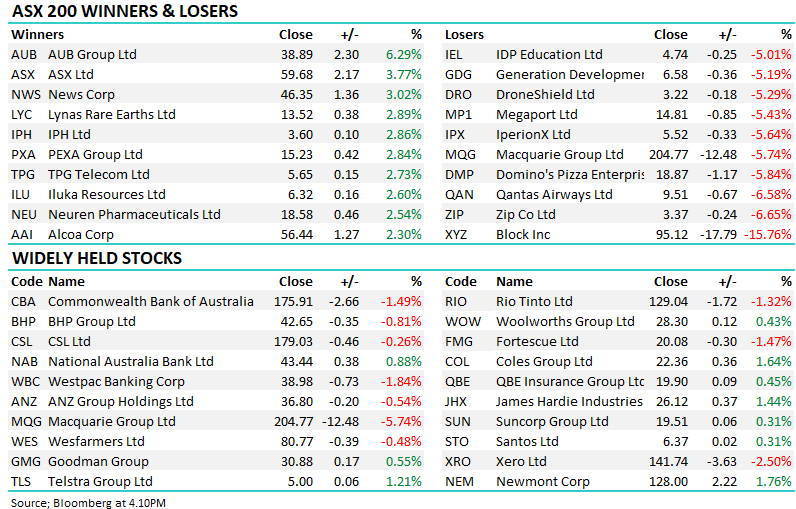

Underneath the hood, the selling was noticeably focused on China-facing names but with over 75% of the market closing lower there were few places to hide, the Real Estate -1.2% and Materials -1.7% Sectors caught our attention while another +0.5% advance by the energy names helped offset some of the market’s weakness. The local earnings season is outperforming negative expectations although we are seeing expectations adjusted lower for FY24 but it hasn’t been enough to offset growing concerns around China, remember as we said yesterday when things look their worst opportunities often present themselves.

We have been waiting patiently to increase our exposure to the Resources Sector, now we need to decide if Beijing’s current failure to lift China’s economy is delivering “pennies from heaven” in terms of entry opportunities to the local miners or whether it’s more akin to fool’s gold – the core question we will look to answer later today – we’ve covered this ground a few times in 2023 but when a sector that’s in our sights is getting knocked about it warrants close scrutiny.

- The ASX200 is poised to open flat this morning with the SPI futures failing to embrace a solid session on Wall Street e.g. the S&P500 advanced +0.6%.

This morning we’ve briefly looked at 3 stocks that caught our attention for different reasons, although unfortunately the 2 we own in our Flagship Growth Portfolio both dipped on the day: