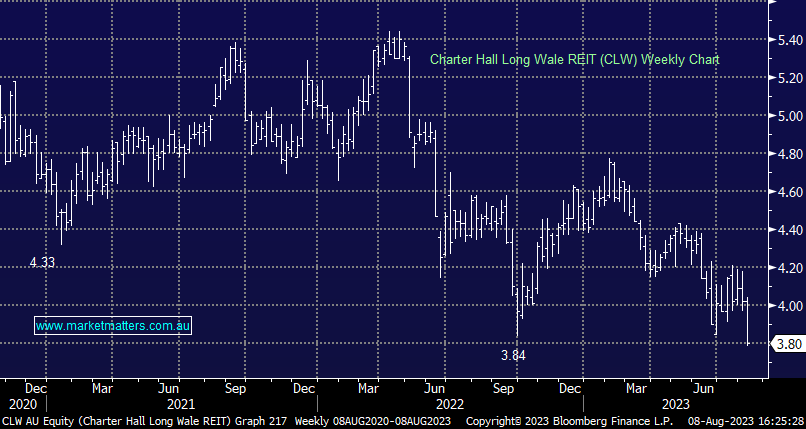

CLW -5.71%: Was a very interesting result today with worthwhile takeaways for our thinking on the broader property sector. While we have not had any interest in owning CLW for some time, given we viewed it as akin to buying a longer-dated bond that would struggle in a rising rate environment, after today’s move, it has piqued our interest. The one-liner is that higher debt costs drive a miss in earnings guidance for FY24, which was ~8% below consensus while look-through gearing which takes into consideration debt on properties at 40.1% has ticked up. The cost to service their debt increased and that’s the main issue that will hurt earnings. As a reminder, CLW has long leases (WALE 11.2 years) to safe tenants (mainly Government) and is fairly boring in nature, but small movements impact leveraged positions which CLW is, and that leverage drove a ~10% decline in NTA.

- Not one for right now, but worth keeping a handle on CLW we think.