Hi Scott,

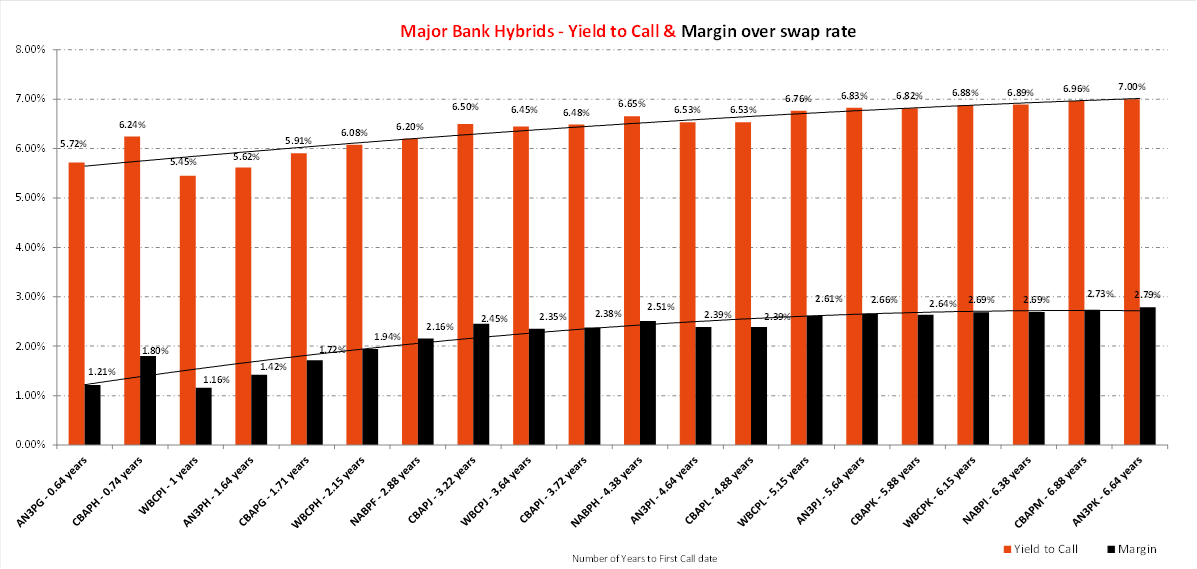

A tightening of spreads is the reason for movement up in prices, and this can happen due to lower perceived risk in the securities or the market as a whole, while there has also been a lack of new issuance, reducing supply and therefore buying on market is the only way to go. We don’t intend to reduce our hybrid weighting in the Income Portfolio which sits at around 25%, although we do think Hybrids are on the expensive side with spreads in Major Bank notes ~2.60% as shown in the black bars on the chart below. For those not familiar with Hybrids, think about the spread as the premium over and above cash we are being paid to take on the additional risk. From memory, the last new issue came from CBA and it was priced at a spread of 3%.

Also worth noting that most Hybrids do have accrued interest built up – about 2 months worth, with most going ex in around 30 days.