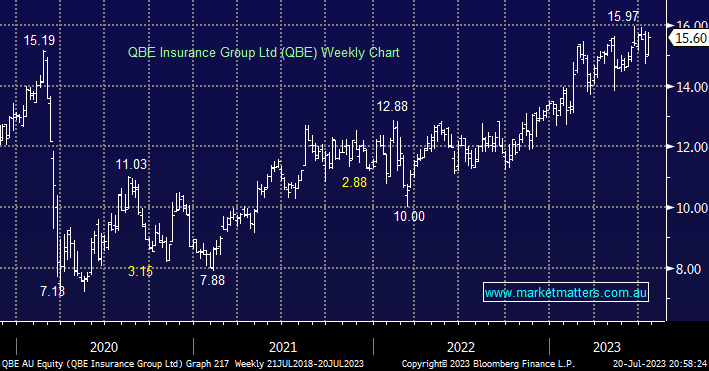

QBE advanced +2.4% helped by a rise in bond yields and preliminary 1H numbers which looked strong with Gross Written Premiums (GWP) of $12.8b accompanied by strong investment returns. Importantly the company maintained guidance for FY23 – they will report full 1H numbers on August 10th. We like the way the insurance business is evolving moving forward but our view toward bond yields if correct will create a headwind for QBE’s earnings.

- In line with our view towards bonds we are targeting a break of $14 by QBE in 2H.