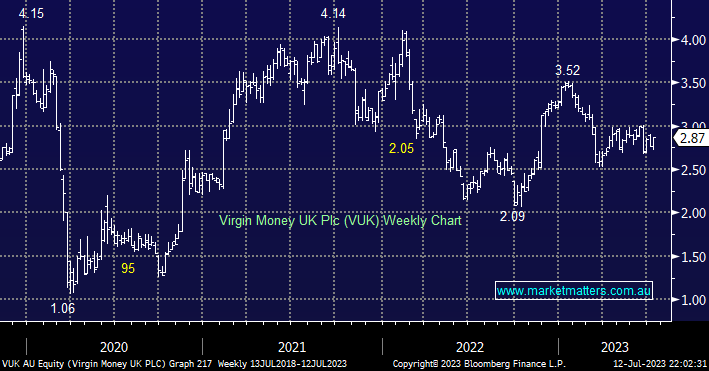

VUK rallied +3.2% yesterday making it the main board’s 5th best-performing stock and by far the best move amongst the banks. However, in early London trade, the stock had surged over +8% following the news that it had passed “Stress Tests” unlocking capital which could be used for buybacks – Morgan Stanley said Virgin Money “comfortably” passed the stress test. We believe the stock is cheap as it traded on 4.9x estimated earnings for FY23 plus an estimated yield in excess of 7% over the next 12 months is attractive. We continue to prefer VUK over the Australian regional banks for investors who are looking for some deep value, high-beta exposure to the Banking Sector.

- We like the risk/reward towards VUK short term with an initial target around $3.50, or +20% higher.