What Matters Today in Markets: Listen Here each morning

The RBA took centre stage at 2.30 pm on Tuesday and they happily opted to hit the pause button for the 2nd time in 4-months, perhaps hope does spring eternal, we’ve discussed our view over recent weeks that the market had become too hawkish and although it’s very early days we’re sticking with our peak interest rate target of 4.35-4.5% with an outside possibility that the current 4.1% is already the end of Phillip Lowes hiking cycle:

- On Tuesday the RBA left rates at 4.1%, our preferred scenario but it was a relatively tight call.

The accompanying rhetoric offered hope to equities although bonds and the $A weren’t convinced ending the days little changed as Dr Lowe left the door open for further hikes by saying it will take some time to assess the impact of the aggressive tightening cycle, this of course might end up having a double-edged meaning as the results of the unfolding “mortgage cliff” could start to show they’ve already gone too hard. Overall we believe it was a good result for stocks:

- “The combination of higher interest rates and cost-of-living pressures is leading to a substantial slowing in household spending.”

- “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve,”

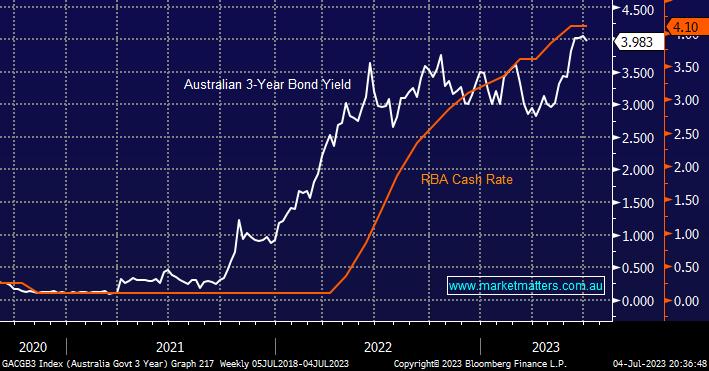

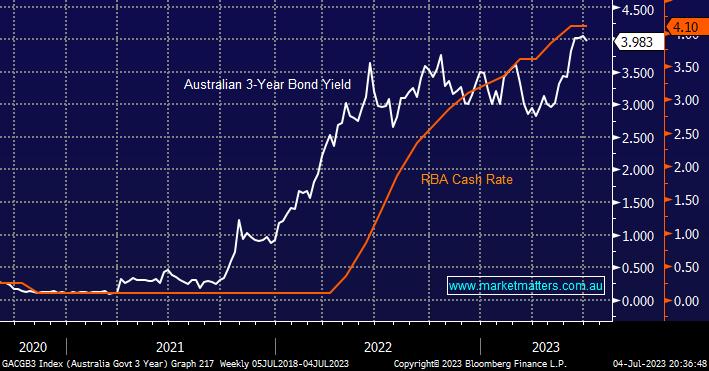

A simple look at the cash rate and short-term bond yields paints a clear picture that the upside momentum is waning – remember historically buying the pause delivers the best returns after a hiking cycle.

The ASX200 embraced the RBA pause yesterday rallying +0.6% after the announcement on fairly broad-based buying that saw over 70% of the main board close higher, positive sentiment was compounded by a fresh bout of M&A action with Costa Group (CGC) and Austal (ASB) reminding Active Investors like ourselves that stocks will only remain undervalued for so long before the buyers surface. All local stocks need now is further economic stimulus from China and a break out to all-time highs will be back on the table, now less than 5% away.

On the commodities front lithium stocks rallied aggressively early in the session following the strong quarterly from Tesla (TSLA US) but by 4 pm the energy complex and gold stocks had largely overtaken the EV-related names – Whitehaven Coal (WHC) +2.4%, Evolution Mining (EVN) +1.8%, Woodside (WDS) +1.4%, Newcrest Mining (NCM) +1.1% compared to Pilbara Minerals (PLS) +2.2%, IGO Ltd (IGO) Ltd +1.2%, and Allkem (AKE) -0.4%. In hindsight we took profit 48 hours too early in PLS but we’re still happy with our switch to Lend Lease (LLC) which added another +1.8% on Tuesday.

The US markets were closed overnight for Independence Day and the S&P500 futures fell just -0.04% illustrating the day was all about turkey, friends and family.

- Following slightly weaker sessions on European bourses and the drift in US Futures the SPI Futures are calling the ASX200 to open down -0.2%.